Business, 02.10.2019 05:00 ayaanwaseem

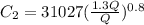

Company a is considering building a new warehouse, which has 30% more square footage than the old warehouse. the old warehouse was constructed 9 years ago, with a cost of $2. during the past 9 years, the cost of constucting a warehouse have risen by an average of 5% per year. if the cost-capacity factor, based on square footage, is 0.8, what would be the estimated cost of the new warehouse? round your answer to the nearest integer.

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

Which of the following statements is true regarding the definition of a fund? a fund is a fiscal entity which is designed to provide reporting that demonstrates conformance with finance-related legal and contractual provisions separately from gaap reporting. a fund exists to assist in carrying on activities and attaining objectives where there are no specific rules or restrictions. a fund is an accounting entity which is designed to enable reporting in conformity with gaap without being restricted by legal or contractual provisions. a fund is a mechanism developed to provide accounting for revenues and expenditures that are subject to certain restrictions separate from revenues and expenditures that are not subject to restrictions.

Answers: 1

Business, 22.06.2019 00:30

Norton manufacturing expects to produce 2,900 units in january and 3,600 units in february. norton budgets $20 per unit for direct materials. indirect materials are insignificant and not considered for budgeting purposes. the balance in the raw materials inventory account (all direct materials) on january 1 is $38,650. norton desires the ending balance in raw materials inventory to be 10% of the next month's direct materials needed for production. desired ending balance for february is $51,100. what is the cost of budgeted purchases of direct materials needed for january? $58,000 $65,200 $26,550 $25,150

Answers: 1

Business, 22.06.2019 15:50

Singer and mcmann are partners in a business. singer’s original capital was $40,000 and mcmann’s was $60,000. they agree to salaries of $12,000 and $18,000 for singer and mcmann respectively and 10% interest on original capital. if they agree to share remaining profits and losses on a 3: 2 ratio, what will mcmann’s share of the income be if the income for the year was $15,000?

Answers: 1

Business, 22.06.2019 16:50

Slow ride corp. is evaluating a project with the following cash flows: year cash flow 0 –$12,000 1 5,800 2 6,500 3 6,200 4 5,100 5 –4,300 the company uses a 11 percent discount rate and an 8 percent reinvestment rate on all of its projects. calculate the mirr of the project using all three methods using these interest rates.

Answers: 2

You know the right answer?

Company a is considering building a new warehouse, which has 30% more square footage than the old wa...

Questions

Mathematics, 04.02.2021 17:10

Chemistry, 04.02.2021 17:10

Social Studies, 04.02.2021 17:10

Mathematics, 04.02.2021 17:10

World Languages, 04.02.2021 17:10

Mathematics, 04.02.2021 17:10

Social Studies, 04.02.2021 17:10

History, 04.02.2021 17:10

Mathematics, 04.02.2021 17:10

Social Studies, 04.02.2021 17:10

Mathematics, 04.02.2021 17:10

English, 04.02.2021 17:10

Mathematics, 04.02.2021 17:10