Business, 02.10.2019 01:30 shaelyn0920

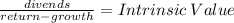

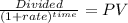

The duo growth company just paid a dividend of $1 per share. the dividend is expected to grow at a rate of 25% per year for the next 3 years and then to level off to 5% per year forever. you think the appropriate market capitalization rate is 20% per year. (a) what is your estimate of the intrinsic value of a share of the stock? (b) if the market price of a share is equal to this intrinsic value, what is the expected dividend yield? (c) what do you expect its price to be 1 year from now? is the implied capital gain consistent with your estimate of the dividend yield and the market capitalization rate? explain.

Answers: 1

Another question on Business

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

Business, 22.06.2019 23:10

R& m chatelaine is one of the largest tax-preparation firms in the united states. it wants to acquire the tax experts, a smaller rival. after the merger, chatelaine will be one of the two largest income-tax preparers in the u.s. market. what should chatelaine include in its acquisition plans? it should refocus its attention from the national to the international market. in addition to acquiring the tax experts, it should also determine the best way to drive independent "mom and pop" tax preparers out of business. chatelaine will need to explain to the federal trade commission how the acquisition will not result in an increase in prices for consumers. chatelaine should enter a price-based competition with its other major competitor to force it out of business and become a monopoly.

Answers: 3

Business, 23.06.2019 08:20

Marque a alternativa que apresenta somente as opções de financiamento com recursos internos: a) lucros, venda de ativos e recursos próprios. b) lucros, venda de ativos e redução no capital de giro. c) lucros, venda de ativos e recursos de familiares. d) lucros, venda de ativos e prorrogação nos prazos para receber os pagamentos dos clientes. e) lucros, venda de ativos e aumento do estoque de mercadorias.

Answers: 1

Business, 23.06.2019 09:30

If gerry is approved for a $150,000 mortgage at 3.75 percent interest for a 30-day loan, what would the monthly payment be?

Answers: 1

You know the right answer?

The duo growth company just paid a dividend of $1 per share. the dividend is expected to grow at a r...

Questions

Mathematics, 26.08.2019 16:10

Mathematics, 26.08.2019 16:10

Mathematics, 26.08.2019 16:10

Physics, 26.08.2019 16:10

English, 26.08.2019 16:10

Business, 26.08.2019 16:10

History, 26.08.2019 16:10

![\left[\begin{array}{ccc}Year÷nds&PV\\0&1&1\\1&1.25&1.0417\\2&1.563&1.0854\\3&1.954&1.1308\\3&13.678&7.9155\\Total&&11.17\\\end{array}\right]](/tpl/images/0281/5746/52503.png)