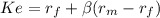

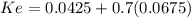

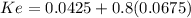

Company a has a beta of 0.70, while company b's beta is 0.80. the required return on the stock market is 11.00%, and the risk-free rate is 4.25%. what is the difference between a's and b's required rates of return? (hint: first find the market risk premium, then find the required returns on the stocks.)

Answers: 3

Another question on Business

Business, 22.06.2019 03:30

Nellie lumpkin, who suffered from dementia, was admitted to the picayune convalescent center, a nursing home. because of her mental condition, her daughter, beverly mcdaniel, signed the admissions agreement. it included a clause requiring the par- ties to submit any dispute to arbitration. after lumpkin left the center two years later, she filed a suit against picayune to recover damages for mistreatment and malpractice. [covenant health & rehabilitation of picayune, lp v. lumpkin, 23 so.2d 1092 (miss. app. 2009)] (see page 91.) 1. is it ethical for this dispute—involving negligent medical care, not a breach of a commercial contract—to be forced into arbitration? why or why not? discuss whether medical facilities should be able to impose arbitration when there is generally no bargaining over such terms.

Answers: 3

Business, 22.06.2019 21:00

The purpose of the transportation approach for location analysis is to minimize which of the following? a. total costsb. total fixed costsc. the number of shipmentsd. total shipping costse. total variable costs

Answers: 1

Business, 23.06.2019 00:30

Which of the following emails should he save in this folder instead of deleting or moving it to another folder

Answers: 1

Business, 23.06.2019 01:30

Which of the following is considered part of a country’s infrastructure?

Answers: 3

You know the right answer?

Company a has a beta of 0.70, while company b's beta is 0.80. the required return on the stock marke...

Questions

Mathematics, 23.05.2020 04:00

Chemistry, 23.05.2020 04:00

Mathematics, 23.05.2020 04:00

Mathematics, 23.05.2020 04:00

Mathematics, 23.05.2020 04:00

Mathematics, 23.05.2020 04:00