Business, 30.09.2019 22:30 aliyyahlove

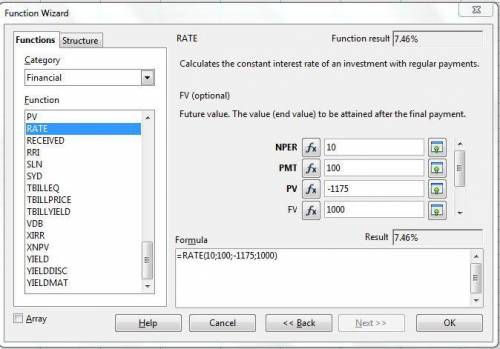

Kempton enterprises has bonds outstanding with a $1,000 face value and 10 years left until maturity. they have an 10% annual coupon payment, and their current price is $1,175. the bonds may be called in 5 years at 109% of face value (call price = $1,090). what is the yield to maturity? round your answer to two decimal places.

Answers: 2

Another question on Business

Business, 21.06.2019 19:10

Maldonia has a comparative advantage in the production of , while lamponia has a comparative advantage in the production of . suppose that maldonia and lamponia specialize in the production of the goods in which each has a comparative advantage. after specialization, the two countries can produce a total of million pounds of lemons and million pounds of coffee.

Answers: 3

Business, 22.06.2019 12:40

Alarge tank is filled to capacity with 500 gallons of pure water. brine containing 2 pounds of salt per gallon is pumped into the tank at a rate of 5 gal/min. the well-mixed solution is pumped out at the same rate. find the number a(t) of pounds of salt in the tank at time t.

Answers: 3

Business, 23.06.2019 04:00

Match the different taxes to the levels at which these taxes are levied on consumers and businesses national level/ national and local levels 1.sales tax 2.income tax 3.payroll tax 4.social security tax 4.property tax

Answers: 1

You know the right answer?

Kempton enterprises has bonds outstanding with a $1,000 face value and 10 years left until maturity....

Questions

Mathematics, 08.01.2021 17:10

Social Studies, 08.01.2021 17:10

History, 08.01.2021 17:10

Computers and Technology, 08.01.2021 17:10

Mathematics, 08.01.2021 17:10

Mathematics, 08.01.2021 17:10