Business, 27.09.2019 05:00 anthony4034

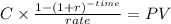

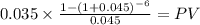

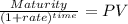

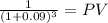

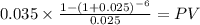

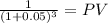

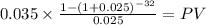

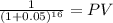

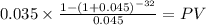

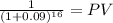

Laurel, inc., and hardy corp. both have 7 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. the laurel, inc., bond has three years to maturity, whereas the hardy corp. bond has 16 years to maturity. if interest rates suddenly rise by 2 percent, what is the percentage change in the price of each bond? if rates were to suddenly fall by 2 percent instead, what would be the percentage change in the price of each bond?

Answers: 1

Another question on Business

Business, 22.06.2019 00:40

Eileen's elegant earrings produces pairs of earrings for its mail order catalogue business. each pair is shipped in a separate box. she rents a small room for $150 a week in the downtown business district that serves as her factory. she can hire workers for $275 a week. there are no implicit costs. what is the marginal product of the second worker?

Answers: 3

Business, 22.06.2019 07:00

Imagine you own an established startup with growing profits. you are looking for funding to greatly expand company operations. what method of financing would be best for you?

Answers: 2

Business, 22.06.2019 12:40

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

Business, 22.06.2019 16:10

Regarding the results of a swot analysis, organizational weaknesses are (a) internal factors that the organization may exploit for a competitive advantage (b) internal factors that the organization needs to fix in order to be competitive (c) mbo skills that should be emphasized (d) skills and capabilities that give an industry advantages problems that a specific industry needs to correct

Answers: 1

You know the right answer?

Laurel, inc., and hardy corp. both have 7 percent coupon bonds outstanding, with semiannual interest...

Questions

English, 12.11.2019 04:31

Physics, 12.11.2019 04:31

Mathematics, 12.11.2019 04:31

Mathematics, 12.11.2019 04:31

Mathematics, 12.11.2019 04:31

English, 12.11.2019 04:31

Mathematics, 12.11.2019 04:31

English, 12.11.2019 04:31

History, 12.11.2019 04:31

History, 12.11.2019 04:31

Mathematics, 12.11.2019 04:31

History, 12.11.2019 04:31

Mathematics, 12.11.2019 04:31