Business, 26.09.2019 19:10 genyjoannerubiera

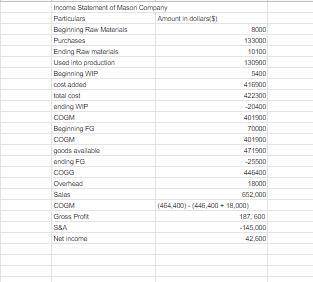

The following data from the just completed year are taken from the accounting records of mason company: sales $ 652,000 direct labor cost $ 81,000 raw material purchases $ 133,000 selling expenses $ 102,000 administrative expenses $ 43,000 manufacturing overhead applied to work in process $ 205,000 actual manufacturing overhead costs $ 223,000 inventories beginning ending raw materials $ 8,000 $ 10,100 work in process $ 5,400 $ 20,400 finished goods $ 70,000 $ 25,500 required: 1. prepare a schedule of cost of goods manufactured. assume all raw materials used in production were direct materials. 2. prepare a schedule of cost of goods sold. assume that the company's underapplied or overapplied overhead is closed to cost of goods sold. 3. prepare an income statement.

Answers: 3

Another question on Business

Business, 21.06.2019 20:20

Atoy manufacturer makes its own wind-up motors, which are then put into its toys. while the toy manufacturing process is continuous, the motors are intermittent flow. data on the manufacture of the motors appears below.annual demand (d) = 50,000 units daily subassembly production rate = 1,000setup cost (s) = $85 per batch daily subassembly usage rate = 200carrying cost = $.20 per unit per year(a) to minimize cost, how large should each batch of subassemblies be? (b) approximately how many days are required to produce a batch? (c) how long is a complete cycle? (d) what is the average inventory for this problem? (e) what is the total annual inventory cost (holding plus setup) of the optimal behavior in this problem?

Answers: 2

Business, 21.06.2019 22:40

Which economic indicators are used to measure the global economy? check all that apply. a. purchasing power parity b. trade volumes c. spending power parity d. labor market data e. gross domestic product f. trade deficits and surpluses

Answers: 3

Business, 22.06.2019 13:30

Presented below is information for annie company for the month of march 2018. cost of goods sold $245,000 rent expense $ 36,000 freight-out 7,000 sales discounts 8,000 insurance expense 5,000 sales returns and allowances 11,000 salaries and wages expense 63,000 sales revenue 410,000 instructions prepare the income statement.

Answers: 2

Business, 22.06.2019 20:20

Faldo corp sells on terms that allow customers 45 days to pay for merchandise. its sales last year were $325,000, and its year-end receivables were $60,000. if its dso is less than the 45-day credit period, then customers are paying on time. otherwise, they are paying late. by how much are customers paying early or late? base your answer on this equation: dso - credit period = days early or late, and use a 365-day year when calculating the dso. a positive answer indicates late payments, while a negative answer indicates early payments.a. 21.27b. 22.38c. 23.50d. 24.68e. 25.91b

Answers: 2

You know the right answer?

The following data from the just completed year are taken from the accounting records of mason compa...

Questions

Mathematics, 05.03.2021 01:00

Chemistry, 05.03.2021 01:00

Mathematics, 05.03.2021 01:00

Mathematics, 05.03.2021 01:00

Mathematics, 05.03.2021 01:00

Geography, 05.03.2021 01:00

Mathematics, 05.03.2021 01:00

Physics, 05.03.2021 01:00

Mathematics, 05.03.2021 01:00

History, 05.03.2021 01:00

Mathematics, 05.03.2021 01:00