Business, 26.09.2019 16:20 rhucke99121

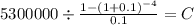

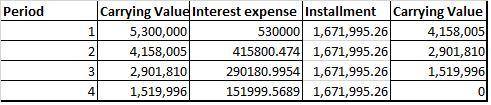

American food services, inc., acquired a packaging machine from barton and barton corporation. barton and barton completed construction of the machine on january 1, 2018. in payment for the $5.3 million machine, american food services issued a four-year installment note to be paid in four equal payments at the end of each year. the payments include interest at the rate of 10%. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) required 1. prepare the journal entry for american food services' purchase of the machine on january 1, 2018. 2. prepare an amortization schedule for the four-year term of the installment note. 3. prepare the journal entry for the first installment payment on december 31, 2018. 4. prepare the journal entry for the third installment payment on december 31, 2020 complete this question by entering your answers in the tabs below req 1 3 and 4 prepare an amortization schedule for the four-year term of the installment note.

Answers: 2

Another question on Business

Business, 22.06.2019 12:30

Sales at a fast-food restaurant average $6,000 per day. the restaurant decided to introduce an advertising campaign to increase daily sales. to determine the effectiveness of the advertising campaign, a sample of 49 days of sales were taken. they found that the average daily sales were $6,300 per day. from past history, the restaurant knew that its population standard deviation is about $1,000. if the level of significance is 0.01, have sales increased as a result of the advertising campaign? multiple choicea)fail to reject the null hypothesis.b)reject the null hypothesis and conclude the mean is higher than $6,000 per day.c)reject the null hypothesis and conclude the mean is lower than $6,000 per day.d)reject the null hypothesis and conclude that the mean is equal to $6,000 per day.expert answer

Answers: 3

Business, 22.06.2019 14:50

Prepare beneish corporation's income statement and statement of stockholders' equity for year-end december 31, and its balance sheet as of december 31. there were no stock issuances or repurchases during the year. (do not use negative signs with your answers unless otherwise noted.)

Answers: 2

Business, 22.06.2019 19:20

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

Business, 22.06.2019 19:40

Your father's employer was just acquired, and he was given a severance payment of $375,000, which he invested at a 7.5% annual rate. he now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. how many years will it take to exhaust his funds, i.e., run the account down to zero? a. 22.50 b. 23.63 c. 24.81 d. 26.05 e. 27.35

Answers: 2

You know the right answer?

American food services, inc., acquired a packaging machine from barton and barton corporation. barto...

Questions

Engineering, 13.10.2020 18:01

Spanish, 13.10.2020 18:01

Spanish, 13.10.2020 18:01

History, 13.10.2020 18:01

Mathematics, 13.10.2020 18:01

English, 13.10.2020 18:01

Mathematics, 13.10.2020 18:01

Mathematics, 13.10.2020 18:01

History, 13.10.2020 18:01

Mathematics, 13.10.2020 18:01

History, 13.10.2020 18:01