Business, 24.09.2019 02:00 GreenHerbz206

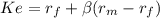

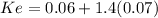

Hr industries (hri) has a beta of 1.4, while lr industries's (lri) beta is 1.0. the risk-free rate is 6%, and the required rate of return on an average stock is 13%. the expected rate of inflation built into rrf falls by 1.5 percentage points; the real risk-free rate remains constant; the required return on the market falls to 10.5%; and all betas remain constant. after all of these changes, what will be the difference in the required returns for hri and lri? round your answer to two decimal places.

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

Highland company produces a lightweight backpack that is popular with college students. standard variable costs relating to a single backpack are given below

Answers: 1

Business, 22.06.2019 01:50

Which statement below best describes george waring's approach to solving the problems of water-borne illness? a. waring is going with his "gut," because he believes that instincts and emotions are the best guides for action. b. waring efficiently and thoroughly lays out the case for why the problems are too large and overwhelming to be solved: people should just move out of cities back to their farms. c. waring has gathered the testimonies of people who live in densely populated areas in order to learn how they themselves have solved their problems. d. waring exhibits the industrial age's increased respect for and reliance on science and the scientific method.

Answers: 1

Business, 22.06.2019 05:30

From a business perspective, an information system provides a solution to a problem or challenge facing a firm and represents a combination of management, organization, and technology elements. the organization's hierarchy, functional specialties, business processes, culture, and political interest groups are components of which element of information systems?

Answers: 1

Business, 22.06.2019 19:40

The common stock of ncp paid $1.35 in dividends last year. dividends are expected to grow at an annual rate of 5.30 percent for an indefinite number of years. a. if ncp's current market price is $22.57 per share, what is the stock's expected rate of return? b. if your required rate of return is 7.3 percent, what is the value of the stock for you? c. should you make the investment? a. if ncp's current market price is $22.57 per share, the stock's expected rate of return is

Answers: 3

You know the right answer?

Hr industries (hri) has a beta of 1.4, while lr industries's (lri) beta is 1.0. the risk-free rate i...

Questions

Mathematics, 08.11.2020 04:20

Physics, 08.11.2020 04:20

Mathematics, 08.11.2020 04:20

Mathematics, 08.11.2020 04:20

Mathematics, 08.11.2020 04:20

Mathematics, 08.11.2020 04:20

English, 08.11.2020 04:20

Mathematics, 08.11.2020 04:20

Physics, 08.11.2020 04:20

Mathematics, 08.11.2020 04:20

Spanish, 08.11.2020 04:20

Mathematics, 08.11.2020 04:20

Social Studies, 08.11.2020 04:20