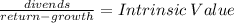

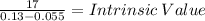

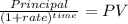

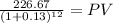

Metallica bearings, inc., is a young start-up company. no dividends will be paid on the stock over the next 11 years, because the firm needs to plow back its earnings to fuel growth. the company will pay a dividend of $17 per share exactly 12 years from today and will increase the dividend by 5.5 percent per year thereafter. if the required return on this stock is 13 percent, what is the current share price according to ddm?

Answers: 3

Another question on Business

Business, 22.06.2019 04:00

Match the type of agreements to their descriptions. will trust living will prenuptial agreement

Answers: 2

Business, 22.06.2019 05:50

Which is one solution to levy the complexity of the global matrix strategy with added customer-focused dimensions?

Answers: 3

Business, 22.06.2019 19:00

Describe how to write a main idea expressed as a bottom-line statement

Answers: 3

Business, 22.06.2019 21:00

On july 2, year 4, wynn, inc., purchased as a short-term investment a $1 million face-value kean co. 8% bond for $910,000 plus accrued interest to yield 10%. the bonds mature on january 1, year 11, and pay interest annually on january 1. on december 31, year 4, the bonds had a fair value of $945,000. on february 13, year 5, wynn sold the bonds for $920,000. in its december 31, year 4, balance sheet, what amount should wynn report for the bond if it is classified as an available-for-sale security?

Answers: 3

You know the right answer?

Metallica bearings, inc., is a young start-up company. no dividends will be paid on the stock over t...

Questions

History, 18.04.2021 19:50

Mathematics, 18.04.2021 19:50

Mathematics, 18.04.2021 19:50

Business, 18.04.2021 19:50

Chemistry, 18.04.2021 19:50

Mathematics, 18.04.2021 19:50

English, 18.04.2021 19:50

Mathematics, 18.04.2021 19:50

Chemistry, 18.04.2021 19:50