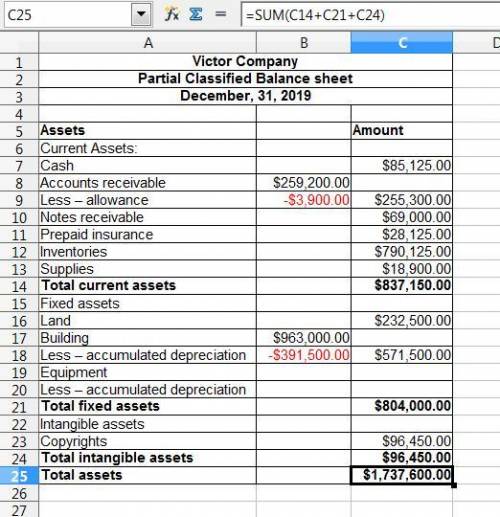

Presented below is information related to victor company at december 31, 2019. assume a tax rate of 30% on all items. account title amount account title amtaccounts payable $ 204,975 income taxes payable 78,000accounts receivable 259,200 interest payable 2,850accum. depreciation - building - 391,500 inventory 790,125additional paid-in capital 81,900 land 232,500allowance for doubtful accounts 3,900 notes payable-short-term 96,000notes receivable due in 6 months. 69,000bonds payable (due 2025) 600,000 preferred stock 375,000buildings 963,000 prepaid insurance 28,125cash 85,125 salaries and wages payable 17,100common stock 562,500 supplies 18,900copyrights 96,450 trading securities 36,300debt investments (long-term) 140,700 retained earnings 306,000requirements: prepare the asset section of a classified balance sheet for victor company using the report form. include all headings, subheading, subtotals, and totals (with labels) that appear on a classified balance sheet.

Answers: 2

Another question on Business

Business, 22.06.2019 06:00

Select the correct answer a research organization conducts certain chemical tests on samples. they have data available on the standard results. some of the samples give results outside the boundary of the standard results. which data mining method follows a similar approach? o a. data cleansing ob. network intrusion o c. fraud detection od. customer classification o e. deviation detection

Answers: 1

Business, 22.06.2019 15:00

Oerstman, inc. uses a standard costing system and develops its overhead rates from the current annual budget.the budget is based on an expected annual output of 120,000 units requiring 480,000 direct labor hours.(practical capacity is 500,000 hours)annual budgeted overhead costs total $772,800, of which $556,800 is fixed overhead.a total of 119,300 units, using 478,000 direct labor hours, were produced during the year.actual variable overhead costs for the year were $260,400 and actual fixed overhead costs were $555,450.required: 1. compute the fixed overhead spending variance and indicate if favorable or unfavorable.2. compute the fixed overhead volume variance and indicate if favorable or unfavorable.

Answers: 3

Business, 22.06.2019 21:00

An important source of public scrutiny is "watchdogs." these are: the efforts of a firm's competitors, including how often the competitors attack the firm's strategies. taxpayer-supported government agencies that limit a firm's ability to compete in foreign markets. companies designated by the government to only produce products that support the government defense program. socially conscious groups that make it their mission to measure the social responsibility levels of businesses, and provide consumers with their opinions about the level of corporate responsibility of various companies.

Answers: 2

Business, 23.06.2019 00:50

Exercise 12-7 shown below are comparative balance sheets for flint corporation. flint corporation comparative balance sheets december 31 assets 2017 2016 cash $ 201,348 $ 65,142 accounts receivable 260,568 225,036 inventory 494,487 559,629 land 236,880 296,100 equipment 769,860 592,200 accumulated depreciation—equipment (195,426 ) (94,752 ) total $1,767,717 $1,643,355 liabilities and stockholders’ equity accounts payable $ 115,479 $ 127,323 bonds payable 444,150 592,200 common stock ($1 par) 639,576 515,214 retained earnings 568,512 408,618 total $1,767,717 $1,643,355 additional information: 1. net income for 2017 was $275,373. 2. depreciation expense was $100,674. 3. cash dividends of $115,479 were declared and paid. 4. bonds payable amounting to $148,050 were redeemed for cash $148,050. 5. common stock was issued for $124,362 cash. 6. no equipment was sold during 2017. 7. land was sold for its book value. prepare a statement of cash flows for 2017 using the indirect method.

Answers: 1

You know the right answer?

Presented below is information related to victor company at december 31, 2019. assume a tax rate of...

Questions

Mathematics, 27.04.2021 01:00

Physics, 27.04.2021 01:00

Mathematics, 27.04.2021 01:00

Mathematics, 27.04.2021 01:00

History, 27.04.2021 01:00

Mathematics, 27.04.2021 01:00

Computers and Technology, 27.04.2021 01:00

Chemistry, 27.04.2021 01:00

Chemistry, 27.04.2021 01:00

Health, 27.04.2021 01:00

Biology, 27.04.2021 01:00

Mathematics, 27.04.2021 01:00

Chemistry, 27.04.2021 01:00

Mathematics, 27.04.2021 01:00