Business, 18.09.2019 22:30 behemoth42

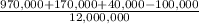

At the beginning of 2017, aristotle company acquired a mine for $970,000. of this amount, $100,000 was ascribed to the land value and the remaining portion to the minerals in the mine. surveys conducted by geologists have indicated that approximately 12,000,000 units of ore appear to be in the mine. aristotle incurred $170,000 of development costs associated with this mine prior to any extraction of minerals. it also determined that the fair value of its obligation to prepare the land for an alternative use when all of the mineral has been removed was $40,000. during 2017, 2,500,000 units of ore were extracted and 2,100,000 of these units were sold. compute the following. collapse question part (a) the total amount of depletion for 2017. (round per unit answer to 2 decimal places, e. g. 0.45 for computational purpose and final answer to 0 decimal places, e. g. 45,892.)

Answers: 2

Another question on Business

Business, 22.06.2019 03:30

Eagle sporting goods reported the following data at july ​31, 2016​, with amounts adapted in​ thousands: ​(click the icon to view the income​ statement.) ​(click the icon to view the statement of retained​ earnings.) ​(click the icon to view the balance​ sheet.) 1. compute eagle​'s net working capital. 2. compute eagle​'s current ratio. round to two decimal places. 3. compute eagle​'s debt ratio. round to two decimal places. do these values and ratios look​ strong, weak or​ middle-of-the-road? 1. compute eagle​'s net working capital. total current assets - total current liabilities = net working capital 99400 - 30000 = 69400 2. compute eagle​'s current ratio. ​(round answer to two decimal​ places.) total current assets / total current liabilities = current ratio 99400 / 30000 = 3.31 3. compute eagle​'s debt ratio. ​(round answer to two decimal​ places.) total liabilities / total assets = debt ratio 65000 / 130000 = 0.50 do these ratio values and ratios look​ strong, weak or​ middle-of-the-road? net working capital is ▾ . this means ▾ current assets exceed current liabilities current liabilities exceed current assets and is a ▾ negative positive sign. eagle​'s current ratio is considered ▾ middle-of-the-road. strong. weak. eagle​'s debt ratio is considered ▾ middle-of-the-road. strong. weak. choose from any list or enter any number in the input fields and then continue to the next question.

Answers: 3

Business, 22.06.2019 04:30

Galwaysc electronics makes two products. model a requires component a and component c. model b requires component b and component c. new versions of both models are released each year with updated versions of all components. all components are sourced overseas, and abc contracts annually for a quantity of each component before seeing that year’s demand. components are only assembled into finished products once demand for each model is known. for the coming year, alwaysc’s purchasing manner has proposed ordering 500,000 units of component a, 630,000 of component b, and 1,000,000 units of component c. her boss has asked why she has recommended purchasing so much of components a and b when alwaysc will not have enough of component c to fully use all of the inventory of a and b. what factors might the purchasing manager cite to explain her recommended order? explain your reasoning.

Answers: 3

Business, 22.06.2019 07:10

Refer to the payoff matrix. suppose that speedy bike and power bike are the only two bicycle manufacturing firms serving the market. both can choose large or small advertising budgets. is there a nash equilibrium solution to this game?

Answers: 1

Business, 22.06.2019 10:10

Karen is working on classifying all her company’s products in terms of whether they have strong or weak market share and whether this share is in a slow or growing market. what type of strategic framework is she using?

Answers: 2

You know the right answer?

At the beginning of 2017, aristotle company acquired a mine for $970,000. of this amount, $100,000 w...

Questions

English, 08.06.2021 22:20

Physics, 08.06.2021 22:20

Mathematics, 08.06.2021 22:20

Mathematics, 08.06.2021 22:20

History, 08.06.2021 22:20

Mathematics, 08.06.2021 22:20

Mathematics, 08.06.2021 22:20

Mathematics, 08.06.2021 22:20

Mathematics, 08.06.2021 22:20

Mathematics, 08.06.2021 22:20

History, 08.06.2021 22:20