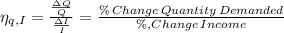

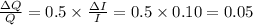

Given the following income elasticities of demand:

product income elasticity

movies +3....

Given the following income elasticities of demand:

product income elasticity

movies +3.4

dental service +1.0

clothing +0.5

the values indicate that movies and dental services are normal goods, but clothing is an inferior good.

(a) a 1 percent increase in income will increase the quantity of movies demanded by 3.4 percent.

(b) a 5 percent increase in the price of dental services will decrease the demand for dental services by 5 percent.

(c) a 10 percent increase in income will increase the demand for clothing by 20 percent.

Answers: 2

Another question on Business

Business, 21.06.2019 14:30

When marietta chooses to only purchase a combination of goods that lie within her budget line, she: is decreasing utility. is maximizing utility. likely has negative savings. must reduce the quantity?

Answers: 2

Business, 22.06.2019 03:40

Electronics assembly inc. is a contract manufacturer that assembles consumer electronics for a number of companies. currently, the operations manager is assessing the capacity requirements as input into a bid for a job to assemble cell phones for a major global company. the company would assemble three models of cell phones in the same assembly cell. setup time between the phones is negligible. electronics assembly inc. operates two 8-hour shifts for 275 days per year. cell phone demand forecast (phones/year) processing time (minutes/phone) mars 47,000 19.8 saturn 35,000 20.7 neptune 7,500 16.2 a. calculate total capacity required by line. b. determine the total operating time available. c. calculate the total number of assembly cells. (round up your answer to the next whole number.)

Answers: 2

Business, 22.06.2019 09:40

The relationship requirement for qualifying relative requires the potential qualifying relative to have a family relationship with the taxpayer. t or fwhich of the following is not a from agi deduction? a.standard deductionb.itemized deductionc.personal exemptiond.none of these. all of these are from agi deductions

Answers: 3

Business, 22.06.2019 13:10

bradford, inc., expects to sell 9,000 ceramic vases for $21 each. direct materials costs are $3, direct manufacturing labor is $12, and manufacturing overhead is $3 per vase. the following inventory levels apply to 2019: beginning inventory ending inventory direct materials 3,000 units 3,000 units work-in-process inventory 0 units 0 units finished goods inventory 300 units 500 units what are the 2019 budgeted production costs for direct materials, direct manufacturing labor, and manufacturing overhead, respectively?

Answers: 2

You know the right answer?

Questions

Mathematics, 21.07.2021 23:40

Mathematics, 21.07.2021 23:40

English, 21.07.2021 23:40

Mathematics, 21.07.2021 23:40

Computers and Technology, 21.07.2021 23:40

Mathematics, 21.07.2021 23:40

Mathematics, 21.07.2021 23:40

Mathematics, 21.07.2021 23:40

Mathematics, 21.07.2021 23:40

Mathematics, 21.07.2021 23:40

Mathematics, 21.07.2021 23:40