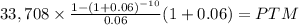

How much should a new graduate pay in 10 equal annual payments, starting 2 years from now, in order to repay a $30,000 loan he has received today? the interest rate is 6% per year. (note: the first payment is made at the end of year 2, so the cash flows are: at initial time = 0; at the end of the first year = 0; at the end of the second year = c, , at the end of the year 10 = c. here "c" denotes the yearly payments. you need to find "c").

Answers: 2

Another question on Business

Business, 22.06.2019 06:30

Double corporation acquired all of the common stock of simple company for

Answers: 2

Business, 22.06.2019 20:00

Afirm is producing at minimum average total cost with its current plant. draw the firm's long-run average cost curve. label it. draw a point on the lrac curve at which the firm cannot lower its average total cost. draw the firm's short-run average total cost curve that is consistent with the point you have drawn. label it.g

Answers: 2

Business, 22.06.2019 20:20

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

Business, 23.06.2019 02:50

Marcus nurseries inc.'s 2005 balance sheet showed total common equity of $2,050,000, which included $1,750,000 of retained earnings. the company had 100,000 shares of stock outstanding which sold at a price of $57.25 per share. if the firm had net income of $250,000 in 2006 and paid out $100,000 as dividends, what would its book value per share be at the end of 2006, assuming that it neither issued nor retired any common stock?

Answers: 1

You know the right answer?

How much should a new graduate pay in 10 equal annual payments, starting 2 years from now, in order...

Questions

Mathematics, 16.11.2020 23:40

English, 16.11.2020 23:40

Mathematics, 16.11.2020 23:40

SAT, 16.11.2020 23:40

Mathematics, 16.11.2020 23:40

Mathematics, 16.11.2020 23:40

Mathematics, 16.11.2020 23:40