Business, 18.09.2019 00:30 jordanrose98

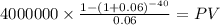

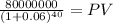

The bradford company issued 10% bonds, dated january 1, with a face amount of $80 million on january 1, 2018. the bonds mature on december 31, 2027 (10 years). for bonds of similar risk and maturity, the market yield is 12%. interest is paid semiannually on june 30 and december 31. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) required: 1. determine the price of the bonds at january 1, 2018. 2. to 4. prepare the journal entry to record their issuance by the bradford company on january 1, 2018, interest on june 30, 2018 and interest on december 31, 2018 (at the effective rate).

Answers: 2

Another question on Business

Business, 22.06.2019 08:20

How much does a neurosurgeon can make most in canada? give me answer in candian dollar

Answers: 1

Business, 22.06.2019 12:30

Suppose that two firms produce differentiated products and compete in prices. as in class, the two firms are located at two ends of a line one mile apart. consumers are evenly distributed along the line. the firms have identical marginal cost, $60. firm b produces a product with value $110 to consumers.firm a (located at 0 on the unit line) produces a higher quality product with value $120 to consumers. the cost of travel are directly related to the distance a consumer travels to purchase a good. if a consumerhas to travel a mile to purchase a good, the incur a cost of $20. if they have to travel x fraction of a mile, they incur a cost of $20x. (a) write down the expressions for how much a consumer at location d would value the products sold by firms a and b, if they set prices p_{a} and p_{b} ? (b) based on your expressions in (a), how much will be demanded from each firm if prices p_{a} and p_{b} are set? (c) what are the nash equilibrium prices?

Answers: 3

Business, 22.06.2019 18:00

Bond j has a coupon rate of 6 percent and bond k has a coupon rate of 12 percent. both bonds have 14 years to maturity, make semiannual payments, and have a ytm of 9 percent. a. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Answers: 2

Business, 22.06.2019 18:10

Find the zeros of the polynomial 5 x square + 12 x + 7 by factorization method and verify the relation between zeros and coefficient of the polynomials

Answers: 1

You know the right answer?

The bradford company issued 10% bonds, dated january 1, with a face amount of $80 million on january...

Questions

Mathematics, 10.12.2020 19:50

World Languages, 10.12.2020 19:50

English, 10.12.2020 19:50

Mathematics, 10.12.2020 19:50

Mathematics, 10.12.2020 19:50

Chemistry, 10.12.2020 19:50

English, 10.12.2020 19:50

Advanced Placement (AP), 10.12.2020 19:50

Mathematics, 10.12.2020 19:50

Mathematics, 10.12.2020 19:50

Mathematics, 10.12.2020 19:50

Social Studies, 10.12.2020 19:50

Mathematics, 10.12.2020 19:50