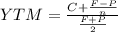

Suppose that ford issues a coupon bonds at a price of $1,000, which is the same as the bond's par value. assume the bond has a coupon rate of 4.5%, pays the coupon once per year, and has a maturity of 20 years. if an investor purchased this bond at the price of $1,000, for each year except the last year, the investor would receive a payment of 45. (round your answers to the nearest dollar) when the bond matures, t investor would receive a final payment of $1045. (round your answers to the nearest dollar.) now suppose the price of the bond changes to $1, 060. assuming an investor purchased the bond at a price of $1, 060, the investor would receive a current yield equal to ()

Answers: 1

Another question on Business

Business, 21.06.2019 20:00

Jorge is a manager at starbucks. his operational plan includes achieving annual sales of $4,000,000 for his store. with only one month left to end of the fiscal year, jorge realizes that he won't reach his annual sales goal. what are his options?

Answers: 2

Business, 22.06.2019 01:30

At the end of the week, carla receives her paycheck and goes directly to the bank after work to make a deposit into her savings account. the bank keeps the required reserve and then loans out the remaining balance to a qualified borrower named malik as a portion of his small business loan. malik uses the loan to buy a tractor for his construction business and makes small monthly payments to the bank to payback the principal balance plus interest on the loan. the bank profits from a portion of the interest payment received and also passes some of the interest back to carla in the form of an interest payment to her savings account. in this example, the bank is acting

Answers: 1

Business, 22.06.2019 03:00

Match the given situations to the type of risks that a business may face while taking credit.(there's not just one answer)1. beta ltd. had taken a loan from a bankfor a period of 15 years, but its salesare gradually showing a decline.2. alpha ltd. has taken a loan for increasing its production and sales,but it has not conducted any researchbefore making this decision.3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession.4. delphi ltd. has taken a short-term loanfrom the bank, but its supply chain logistics are not in place.a. foreign exchange riskb. operational riskc. term of loan riskd. revenue projections risk

Answers: 1

Business, 22.06.2019 23:30

Which career pathways require workers to train at special academies? a.emts and emergency dispatchers b.crossing guards and lifeguards c.police officers and firefighters d.lawyers and judges

Answers: 3

You know the right answer?

Suppose that ford issues a coupon bonds at a price of $1,000, which is the same as the bond's par va...

Questions

Mathematics, 11.03.2020 01:58

Mathematics, 11.03.2020 01:58

Mathematics, 11.03.2020 01:58

Mathematics, 11.03.2020 01:58

English, 11.03.2020 01:58

Mathematics, 11.03.2020 01:58