Business, 13.09.2019 02:20 cnolasco3675

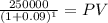

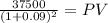

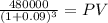

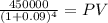

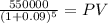

The purple lion beverage company expects the following cash flows from its manufacturing plant in palau over the next five years: annual cash flows year 1 year 2 year 3 year 4 year 5 $250,000 $37,500 $480,000 $450,000 $550,000 the cfo of the company believes that an appropriate annual interest rate on this investment is 9%. what is the present value of this uneven cash flow stream, rounded to the nearest whole dollar? $1,307,822 $767,500 $1,625,000 $2,142,500

Answers: 3

Another question on Business

Business, 22.06.2019 11:40

Vendors provide restaurants with what? o a. cooked items ob. raw materials oc. furniture od. menu recipes

Answers: 1

Business, 22.06.2019 12:40

Which of the following tasks would be a line cook's main responsibility? oa. frying french fries ob. chopping onions oc. taking inventory of stocked dry goods od. paying invoices

Answers: 2

Business, 23.06.2019 00:00

Both renewable and nonrenewable resources are used within our society. how do the uses of nonrenewable resources compare to the uses of renewable resources?

Answers: 1

Business, 23.06.2019 12:00

How might non-industrialized countries be impacted by the foreign exchange market?

Answers: 3

You know the right answer?

The purple lion beverage company expects the following cash flows from its manufacturing plant in pa...

Questions

Mathematics, 04.08.2019 15:00

Biology, 04.08.2019 15:00

History, 04.08.2019 15:00

Biology, 04.08.2019 15:00

English, 04.08.2019 15:00

World Languages, 04.08.2019 15:00

Mathematics, 04.08.2019 15:00

English, 04.08.2019 15:00

English, 04.08.2019 15:00

Mathematics, 04.08.2019 15:00