Business, 11.09.2019 04:30 Lollipop1287

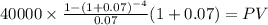

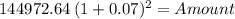

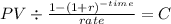

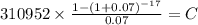

You are saving for the college education of your two children. they are two years apart in age; one will begin college 15 years from today and the other will begin 17 years from today. you estimate your children’s college expenses to be $40,000 per year per child, payable at the beginning of each school year. the appropriate interest rate is 7 percent. your deposits begin one year from today. you will make your last deposit when your oldest child enters college. assume four years of college for each child. how much money must you deposit in an account each year to fund your children’s education?

Answers: 3

Another question on Business

Business, 21.06.2019 21:50

Franklin painting company is considering whether to purchase a new spray paint machine that costs $4,800. the machine is expected to save labor, increasing net income by $720 per year. the effective life of the machine is 15 years according to the manufacturer’s estimate. required determine the unadjusted rate of return based on the average cost of the investment.

Answers: 2

Business, 22.06.2019 02:20

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 03:00

If you were running a company, what are at least two things you could do to improve its productivity.

Answers: 1

Business, 22.06.2019 03:00

Compare the sources of consumer credit 1. consumers use a prearranged loan using special checks 2. consumers use cards with no interest and non -revolving balances 3. consumers pay off debt and credit is automatically renewed 4. consumers take out a loan with a repayment date and have a specific purpose a. travel and entertainment credit b. revolving check credit c. closed-end credit d. revolving credit

Answers: 1

You know the right answer?

You are saving for the college education of your two children. they are two years apart in age; one...

Questions

Mathematics, 13.08.2021 02:50

Mathematics, 13.08.2021 02:50

Mathematics, 13.08.2021 02:50

Mathematics, 13.08.2021 02:50

Geography, 13.08.2021 03:00

Advanced Placement (AP), 13.08.2021 03:00

Mathematics, 13.08.2021 03:00

Mathematics, 13.08.2021 03:00