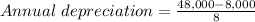

On january 1, 2016, jacob inc. purchased a commercial truck for $48,000 and uses the straight-line depreciation method. the truck has a useful life of eight years and an estimated residual value of $8,000. on december 31, 2017, jacob inc. sold the truck for $43,000. what amount of gain or loss should jacob inc. record on december 31, 2017?

a. gain, $22,000.

b. gain, $5,000.

c. loss, $3,000.

d. loss, $18,000.

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

When partners own different portions of the business, the terms should be stated clearly in what document? the articles of incorporation the executive summary the business summary the partnership agreement

Answers: 3

Business, 22.06.2019 15:10

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

Business, 22.06.2019 17:40

Within the relevant range, if there is a change in the level of the cost driver, then a. total fixed costs will remain the same and total variable costs will change b. total fixed costs will change and total variable costs will remain the same c. total fixed costs and total variable costs will change d. total fixed costs and total variable costs will remain the same

Answers: 3

Business, 22.06.2019 19:40

Aprimary advantage of organizing economic activity within firms is thea. ability to coordinate highly complex tasks to allow for specialized division of labor. b. low administrative costs because of reduced bureaucracy. c. eradication of the principal-agent problem. d. high-powered incentive to work as salaried employees for an existing firm.

Answers: 1

You know the right answer?

On january 1, 2016, jacob inc. purchased a commercial truck for $48,000 and uses the straight-line d...

Questions

English, 27.02.2020 22:56

Mathematics, 27.02.2020 22:56

Mathematics, 27.02.2020 22:56

Mathematics, 27.02.2020 22:57

English, 27.02.2020 22:57

English, 27.02.2020 22:57

Mathematics, 27.02.2020 22:57

Mathematics, 27.02.2020 22:57

Biology, 27.02.2020 22:57