Business, 10.09.2019 21:30 ltorline123

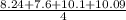

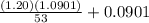

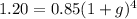

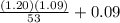

Suppose powers ltd., just issued a dividend of $1.20 per share on it common stock. the company paid dividends of $.85, $.92, $.99, and $1.09 per share in the last four years. if the stock currently sells for $53, what is your best estimate of the company's cost of equity capital using arithmetic and geometric growth rates?

Answers: 3

Another question on Business

Business, 22.06.2019 04:30

Jennifer purchased a house in a brand new development in the outskirts of town. when her house was built, the nearest fire department was nearly 20 miles away. as her neighborhood developed, the density of the community called for a new fire department 1.5 miles away. what effect will the new fire station have on her homeowners insurance premium? a. a new fire department will be more demanding on local taxes. her annual premium will go up. b. the location of a fire department has no bearing on the value of her house. her annual premium will stay the same. c. the new fire department will reduce the risk of financial loss in her home. her annual premium should decrease. d. with a fire department so close (less than 5 miles), financial risk on jennifer’s home practically disappears. she will not need to pay insurance anymore.

Answers: 1

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 23.06.2019 08:30

In the supply-and-demand schedule shown above, the equilibrium price for cell phones is $25 $100 $200

Answers: 2

Business, 23.06.2019 11:00

Match each event to its effect on the equilibrium interest rate and the amount of investment in the loanable funds market. higher interest rate, greater investment higher interest rate, less investment lower interest rate, less investment lower interest rate, greater investment immediate consumer gratification is no longer preferred by people. an efficient new source of energy effectively increases the return on owning a factory. a wave of retirees stops working and begins drawing on retirement savings.

Answers: 3

You know the right answer?

Suppose powers ltd., just issued a dividend of $1.20 per share on it common stock. the company paid...

Questions

Mathematics, 15.01.2021 20:00

Mathematics, 15.01.2021 20:00

Mathematics, 15.01.2021 20:00

Business, 15.01.2021 20:00

Mathematics, 15.01.2021 20:00

Mathematics, 15.01.2021 20:00

Mathematics, 15.01.2021 20:00

Chemistry, 15.01.2021 20:00

Mathematics, 15.01.2021 20:00

Mathematics, 15.01.2021 20:00

English, 15.01.2021 20:00