Business, 10.09.2019 18:30 bensleytristap93y8q

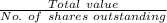

Consider a mutual fund with $260 million in assets at the start of the year and 10 million shares outstanding. the fund invests in a portfolio of stocks that provides dividend income at the end of the year of $2.5 million. the stocks included in the fund's portfolio increase in price by 9%, but no securities are sold and there are no capital gains distributions. the fund charges 12b-1 fees of 1.00%, which are deducted from portfolio assets at year-end. what is the net asset value at the start and end of the year?

Answers: 2

Another question on Business

Business, 22.06.2019 01:00

Throne technical university is looking for three people to work in its plant-biology laboratory. the hiring manager is finding that the most suitable job candidates live in other countries and are not willing to move to the city where the university is located. which situation is the university facing? a. lack of flexible workforce b. surpluses in labor talent c. an appearance of quota systems d. deficits in minimum wage demands

Answers: 1

Business, 22.06.2019 07:10

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u.s. parent on bank deposits held in london d. interest received by a u.s. parent on a loan to a subsidiary in mexico e. principal repayment received by u.s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u.s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 11:30

4. chef a says that broth should be brought to a boil. chef b says that broth should be kept at an even, gentle simmer. which chef is correct? a. neither chef is correct. b. chef a is correct. c. both chefs are correct. d. chef b is correct. student c incorrect which is right answer

Answers: 2

Business, 22.06.2019 19:10

Ancho corp. is an automobile company whose core competency lies in manufacturing petrol- and diesel- based cars. the company realizes that more of its potential customers are switching to electric cars. the r& d department of the company acquires competencies in developing electric cars and launches its first hybrid car, which uses both gas and electricity. in this scenario, ancho is primarilya. leveraging new core competencies to improve current market position. b. redeploying existing core competencies to compete in future markets. c. unlearning existing core competencies to create and compete in markets of the future. d. building new core competencies to protect and extend current market position

Answers: 3

You know the right answer?

Consider a mutual fund with $260 million in assets at the start of the year and 10 million shares ou...

Questions

Social Studies, 05.07.2020 07:01

Chemistry, 05.07.2020 07:01

Mathematics, 05.07.2020 07:01

Biology, 05.07.2020 07:01

Mathematics, 05.07.2020 07:01

Mathematics, 05.07.2020 07:01

History, 05.07.2020 07:01

Mathematics, 05.07.2020 07:01

Mathematics, 05.07.2020 07:01

Mathematics, 05.07.2020 07:01

Law, 05.07.2020 07:01

Mathematics, 05.07.2020 07:01