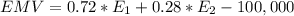

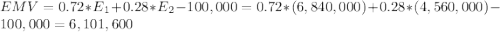

Macdonald products, inc., of clarkson, new york has the option of (a) proceeding immediately with production of a new top-of-of-the-line stereo tv that has just completed prototype testing or (b) having the value analysis team complete a study if ed lusk, vp for operations, proceeds with the existing prototype (option a), the firm can expect sales to be 110,000 units at $520 each, with a probability of 0.68 and a 0.32 probability of 65,000 at $520. if, however, he uses the value analysis team (option b), the firm expets sales of 90,000 units at $760, with a probability of 0.72 and a 0.28 probability of 60,000 units at $760. value engineering, at a cost of $100,000, is only used in option b. which option has the highest expected monetary value (emv)? the emv for option a is $ and the emv for option b is $ therefore, option has the highest expected monetary value. (enter your responses as integers.)

Answers: 1

Another question on Business

Business, 22.06.2019 05:50

Acompany that makes shopping carts for supermarkets and other stores recently purchased some new equipment that reduces the labor content of the jobs needed to produce the shopping carts. prior to buying the new equipment, the company used 6 workers, who produced an average of 79 carts per hour. workers receive $16 per hour, and machine coast was $49 per hour. with the new equipment, it was possible to transfer one of the workers to another department, and equipment cost increased by $11 per hour while output increased by four carts per hour. a) compute the multifactor productivity (mfp) (labor plus equipment) under the prior to buying the new equipment. the mfp (carts/$) = (round to 4 decimal places). b) compute the productivity changes between the prior to and after buying the new equipment. the productivity growth = % (round to 2 decimal places)

Answers: 3

Business, 22.06.2019 10:10

At the end of year 2, retained earnings for the baker company was $3,550. revenue earned by the company in year 2 was $3,800, expenses paid during the period were $2,000, and dividends paid during the period were $1,400. based on this information alone, retained earnings at the beginning of year 2 was:

Answers: 1

Business, 22.06.2019 13:40

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east west sales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 ) the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss)

Answers: 1

Business, 22.06.2019 16:40

Based on what you learned about time management which of these statements are true

Answers: 1

You know the right answer?

Macdonald products, inc., of clarkson, new york has the option of (a) proceeding immediately with pr...

Questions

Mathematics, 24.04.2020 18:09

Mathematics, 24.04.2020 18:09

English, 24.04.2020 18:09

Advanced Placement (AP), 24.04.2020 18:09

Mathematics, 24.04.2020 18:09

Mathematics, 24.04.2020 18:09

Engineering, 24.04.2020 18:10

Geography, 24.04.2020 18:10

Engineering, 24.04.2020 18:10

Mathematics, 24.04.2020 18:10

History, 24.04.2020 18:10

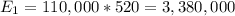

are the earnings of selling 110,000 units at $520 each. So:

are the earnings of selling 110,000 units at $520 each. So:

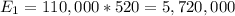

are the earnings of selling 65,000 units at $520 each. So:

are the earnings of selling 65,000 units at $520 each. So: