Business, 06.09.2019 23:20 navjitdosanjh20

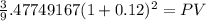

Orwell building supplies' last dividend was $1.75. its dividend growth rate is expected to be constant at 13.00% for 2 years, after which dividends are expected to grow at a rate of 6% forever. its required return (rs) is 12%. what is the best estimate of the current stock price? select the correct answer. a. $36.36 b. $35.02 c. $37.03 d. $37.70 e. $35.69

Answers: 1

Another question on Business

Business, 22.06.2019 00:40

Select the statement that indicates tina's company is a partnership. tina jones is a dancer specializing in latin dance styles. she always wanted to have her own dance studio where she could teach dancing to young and old alike. in 2006, she opened her first dance studio, electric diva, in madison triangle. it was a great choice as a business location because it's well-connected by highways to most places in the city. she leased the space for three years. her initial investment included a good sound system, cheerful interior design, and strong flooring. to raise capital for the business, tina turned to her brother-in-law, philip. philip made half the financial investment. he manages the accounts and social media needs of the business. he has a 30% share in trisha's business. together, they expanded the business to three dance studios in the city and plan to open franchises in other cities.

Answers: 1

Business, 22.06.2019 17:50

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

Business, 22.06.2019 19:00

The market demand curve for a popular teen magazine is given by q = 80 - 10p where p is the magazine price in dollars per issue and q is the weekly magazine circulation in units of 10,000. if the circulation is 400,000 per week at the current price, what is the consumer surplus for a teen reader with maximum willingness to pay of $3 per issue?

Answers: 1

Business, 22.06.2019 19:50

On july 7, you purchased 500 shares of wagoneer, inc. stock for $21 a share. on august 1, you sold 200 shares of this stock for $28 a share. you sold an additional 100 shares on august 17 at a price of $25 a share. the company declared a $0.95 per share dividend on august 4 to holders of record as of wednesday, august 15. this dividend is payable on september 1. how much dividend income will you receive on september 1 as a result of your ownership of wagoneer stock

Answers: 1

You know the right answer?

Orwell building supplies' last dividend was $1.75. its dividend growth rate is expected to be consta...

Questions

Computers and Technology, 18.07.2020 21:01

Advanced Placement (AP), 18.07.2020 21:01

English, 18.07.2020 21:01