Business, 05.09.2019 20:20 winterblanco

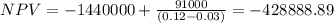

The yurdone corporation wants to set up a private cemetery business. according to the cfo, barry m. deep, business is "looking up". as a result, the cemetery project will provide a net cash inflow of $91,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 3 percent per year forever. the project requires an initial investment of $1,440,000.

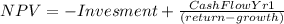

a. what is the npv for the project if yurdone's required return is 12 percent?

b. the company is somewhat unsure about the assumption of a 3 percent growth rate in its cash flows. at what constant growth rate would the company just break even if it still required a return of 12 percent on investment?

Answers: 2

Another question on Business

Business, 22.06.2019 11:00

How did the contribution of the goods producing sector to gdp growth change between 2010 and 2011 a. it fell by 0.3%. b. it fell by 2.3%. c. it rose by 2.3%. d. it rose by 0.6%. the answer is b

Answers: 1

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

Business, 22.06.2019 19:00

Question 55 ted, a supervisor for jack's pool supplies, was accused of stealing pool supplies and selling them to friends and relatives at reduced prices. given ted's earlier track record, he was not fired immediately. the authorities decided to give him an administrative leave, without pay, until the investigation was complete. in view of the given information, it would be most appropriate to say that ted was: demoted. discharged. suspended. dismissed.

Answers: 2

You know the right answer?

The yurdone corporation wants to set up a private cemetery business. according to the cfo, barry m....

Questions

Mathematics, 24.03.2021 23:30

Mathematics, 24.03.2021 23:30

History, 24.03.2021 23:30

Mathematics, 24.03.2021 23:30

Mathematics, 24.03.2021 23:30