Business, 03.09.2019 16:20 andybiersack154

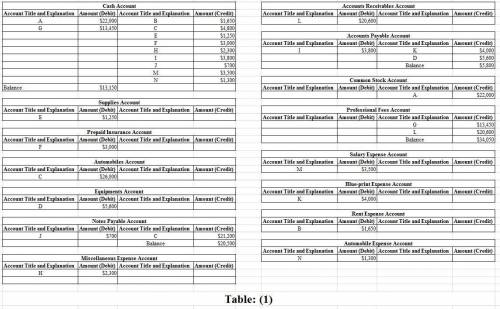

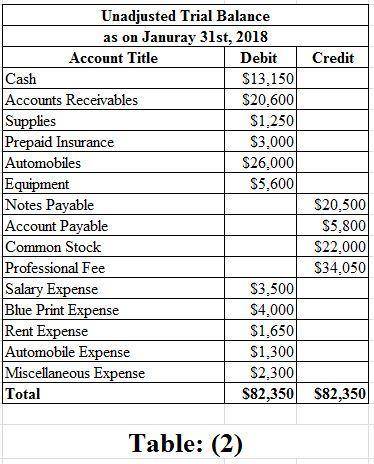

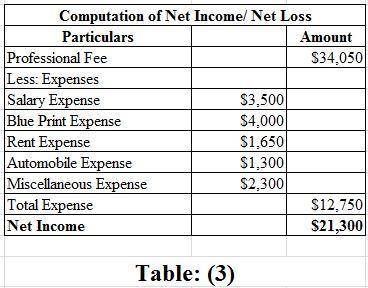

Marjorie knaus, an architect, organized knaus architects on january 1, 2018. during the month, knaus architects completed the following transactions: a. issued common stock to marjorie knaus in exchange for $22,000.b. paid january rent for office and workroom, $1,650.c. purchased used automobile for $26,000, paying $4,800 cash and giving a note payable for the remainder. d. purchased office and computer equipment on account, $5,600.e. paid cash for supplies, $1,250.f. paid cash for annual insurance policies, $3,000.g. received cash from client for plans delivered, $13,450.h. paid cash for miscellaneous expenses, $2,300.i. paid cash to creditors on account, $3,800.j. paid installment due on note payable, $700.k. received invoice for blueprint service, due in february, $4,000.l. recorded fees earned on plans delivered, payment to be received in february, $20,600.m. paid salary of assistants, $3,500.n. paid gas, oil, and repairs on automobile for january, $1,300.required: 1. record these transactions directly in the following t accounts, without journalizing: cash; accounts receivable; supplies; prepaid insurance; automobiles; equipment; notes payable; accounts payable; common stock; professional fees; salary expense; blueprint expense; rent expense; automobile expense; miscellaneous expense. to the left of the amount entered in the accounts, select the appropriate letter to identify the transaction.2. determine account balances of the t accounts. accounts containing a single entry only (such as prepaid insurance) do not need a balance.3. prepare an unadjusted trial balance for knaus architects as of january 31, 2018.4. determine the net income or net loss for january.

Answers: 1

Another question on Business

Business, 21.06.2019 18:20

James sebenius, in his harvard business review article: six habits of merely effective negotiators, identifies six mistakes that negotiators make that keep them from solving the right problem. identify which mistake is being described. striving for a “win-win” agreement results in differences being overlooked that may result in joint gains.

Answers: 2

Business, 22.06.2019 07:30

Most states have licensing registration requirements for child care centers and family daycare homes. these usually include minimum standard for operation. which of the following would you most likely find required in a statement of state licensing standards for child care centers?

Answers: 2

Business, 22.06.2019 12:10

The cost of the beginning work in process inventory was comprised of $3,000 of direct materials, $10,000 of direct labor, and $10,000 of factory overhead. costs incurred during the period were comprised of $15,000 of direct materials costs, and $100,000 of conversion costs. the equivalent units of production (eup) for the period were 9,000 for direct materials and 6,000 for conversion. the costs per eup were:

Answers: 3

Business, 22.06.2019 18:00

In which job role will you be creating e-papers, newsletters, and periodicals?

Answers: 1

You know the right answer?

Marjorie knaus, an architect, organized knaus architects on january 1, 2018. during the month, knaus...

Questions

Biology, 04.06.2020 23:01

Mathematics, 04.06.2020 23:01

Mathematics, 04.06.2020 23:01

Mathematics, 04.06.2020 23:01

Mathematics, 04.06.2020 23:01

Mathematics, 04.06.2020 23:01

Mathematics, 04.06.2020 23:01