Business, 28.08.2019 21:30 dogsarecute278

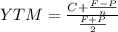

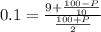

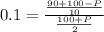

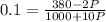

Olympic sports has two issues of debt outstanding. one is a 9% coupon bond with a face value of $20 million, a maturity of 10 years, and a yield to maturity of 10%. the coupons are paid annually. the other bond issue has a maturity of 15 years, with coupons also paid annually, and a coupon rate of 10%. the face value of the issue is $25 million, and the issue sells for 94% of par value. the firm’s tax rate is 35%. (lo13-4) a. what is the before-tax cost of debt for olympic? b. what is olympic’s after-tax cost of debt?

Answers: 1

Another question on Business

Business, 22.06.2019 08:10

The last time he flew jet value air, juan's plane developed a fuel leak and had to make an 4) emergency landing. the time before that, his plane was grounded because of an electrical problem. juan is sure his current trip will be fraught with problems and he will once again be delayed. this is an example of the bias a) confirmation b) availability c) selective perception d) randomness

Answers: 1

Business, 22.06.2019 16:00

What impact might an economic downturn have on a borrower’s fixed-rate mortgage? a. it might cause a borrower’s payments to go up. b. it might cause a borrower’s payments to go down. c. it has no impact because a fixed-rate mortgage cannot change. d. it has no impact because the economy does not affect interest rates.

Answers: 1

Business, 22.06.2019 20:00

Later movers do not face: entrenched competitors. reduced uncertainty over technologies. high growth markets. lower market uncertainty.

Answers: 3

You know the right answer?

Olympic sports has two issues of debt outstanding. one is a 9% coupon bond with a face value of $20...

Questions

Biology, 18.07.2019 16:30

English, 18.07.2019 16:30

English, 18.07.2019 16:30

Mathematics, 18.07.2019 16:30