Business, 28.08.2019 19:20 tdahna0403

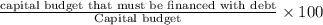

Warren supply inc. is evaluating its capital budget. the company finances with debt and common equity, but because of market conditions, wants to avoid issuing any new common stock during the coming year. it is forecasting an eps of $3.00 for the coming year on its 500,000 outstanding shares of stock. its capital budget is forecasted at $800,000, and it is committed to maintaining a $2.00 dividend per share. given these constraints, what percentage of the capital budget must be financed with debt? a. 30.54%b. 32.15%c. 33.84%d. 35.63%

Answers: 1

Another question on Business

Business, 21.06.2019 14:30

)murphy was consuming 100 units of x and 50 units of y . the price of x rose from 2 to 3. the price of y remained at 4. (a) how much would murphy’s income have to rise so that he can still exactly afford 100 units of x and 50 units of y ? g

Answers: 1

Business, 22.06.2019 13:10

Thomas kratzer is the purchasing manager for the headquarters of a large insurance company chain with a central inventory operation. thomas's fastest-moving inventory item has a demand of 6,000 units per year. the cost of each unit is $100, and the inventory carrying cost is $10 per unit per year. the average ordering cost is $30 per order. it takes about 5 days for an order to arrive, and the demand for 1 week is 120 units. (this is a corporate operation, and the are 250 working days per year.)a) what is the eoq? b) what is the average inventory if the eoq is used? c) what is the optimal number of orders per year? d) what is the optimal number of days in between any two orders? e) what is the annual cost of ordering and holding inventory? f) what is the total annual inventory cost, including cost of the 6,000 units?

Answers: 3

Business, 22.06.2019 14:50

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

You know the right answer?

Warren supply inc. is evaluating its capital budget. the company finances with debt and common equit...

Questions

Mathematics, 23.04.2020 17:24

Mathematics, 23.04.2020 17:24

Mathematics, 23.04.2020 17:24

Mathematics, 23.04.2020 17:24

Mathematics, 23.04.2020 17:25

Mathematics, 23.04.2020 17:25

English, 23.04.2020 17:26