Business, 27.08.2019 22:00 skylarleannjone2751

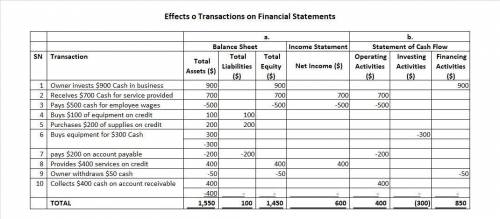

Identify how each of the following separate transactions 1 through 10 affects financial statements. for increases, place a "+" and the dollar amount in the column or columns. for decreases, place a "−" and the dollar amount in the column or columns. some cells may contain both an increase (+) and a decrease (−) along with the dollar amounts. the first transaction is completed as an example. required: a. for the balance sheet, identify how each transaction affects total assets, total liabilities, and total equity. for the income statement, identify how each transaction affects net income. b. for the statement of cash flows, identify how each transaction affects cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

transaction 1 owner invests $900 cash in business in exchange for stock+900 +900 +900 2 receives $700 cash for services provided 3pays $500 cash for employee wages 4 incurs $100 legal costs on credit 5 purchases $200 of supplies on credit 6buys equipment for $300 cash 7 pays $200 on accounts payable 8 provides $400 services on credit 9 pays $50 cash for dividends 10 collects $400 cash on accounts receivable

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

When partners own different portions of the business, the terms should be stated clearly in what document? the articles of incorporation the executive summary the business summary the partnership agreement

Answers: 3

Business, 22.06.2019 19:30

Oz makes lion food out of giraffe and gazelle meat. giraffe meat has 18 grams of protein and 36 grams of fat per pound, while gazelle meat has 36 grams of protein and 18 grams of fat per pound. a batch of lion food must contain at least "46,800" grams of protein and 70,200 grams of fat. giraffe meat costs $1/pound and gazelle meat costs $2/pound. how many pounds of each should go into each batch of lion food in order to minimize costs? hint [see example 2.]

Answers: 1

Business, 22.06.2019 22:00

Acompany's sales in year 1 were $300,000, year 2 were $351,000, and year 3 were $400,000. using year 2 as a base year, the sales percent for year 3 is

Answers: 2

Business, 23.06.2019 02:40

Sean lives in dallas and runs a business that sells boats. in an average year, he receives $722,000 from selling boats. of this sales revenue, he must pay the manufacturer a wholesale cost of $422,000; he also pays wages and utility bills totaling $268,000. he owns his showroom; if he chooses to rent it out, he will receive $2,000 in rent per year. assume that the value of this showroom does not depreciate over the year. also, if sean does not operate this boat business, he can work as a paralegal, receive an annual salary of $21,000 with no additional monetary costs, and rent out his showroom at the $2,000 per year rate. no other costs are incurred in running this boat business.identify each of sean's costs in the following table as either an implicit cost or an explicit cost of selling boats.implicit costexplicit costthe wages and utility bills that sean pays the rental income sean could receive if he chose to rent out his showroom the salary sean could earn if he worked as a paralegal the wholesale cost for the boats that sean pays the

Answers: 2

You know the right answer?

Identify how each of the following separate transactions 1 through 10 affects financial statements....

Questions

History, 01.07.2019 23:00

Arts, 01.07.2019 23:00

Mathematics, 01.07.2019 23:00

Social Studies, 01.07.2019 23:00

Social Studies, 01.07.2019 23:00

Chemistry, 01.07.2019 23:00

Mathematics, 01.07.2019 23:00

Mathematics, 01.07.2019 23:00

History, 01.07.2019 23:00

Health, 01.07.2019 23:00

Chemistry, 01.07.2019 23:00

Biology, 01.07.2019 23:00