Business, 26.08.2019 20:20 michaylabucknep7u3y2

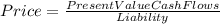

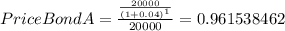

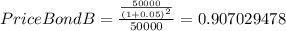

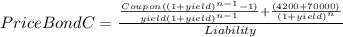

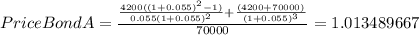

Company abc has liabilities of 20,000, 50,000 and 70,000 due at the end of years 1, 2 and 3 respectively. the company would like to exactly (absolutely) match these liabilities using the following assets: a one-year zero coupon bond with a yield of 4%a two-year zero coupon bond with a yield of 5%a three-year coupon bond with annual coupons of 6% and a yield of 5.5%what is the total cost of the asset portfolio that will exactly match the liabilities?

Answers: 1

Another question on Business

Business, 21.06.2019 14:50

Baker industries’s net income is $24,000, its interest expense is $5,000, and its tax rate is 40%. its notes payable equals $27,000, long-term debt equals $75,000, and common equity equals $250,000. the firm finances with only debt and common equity, so it has no preferred stock. what are the firm’s roe and roic?

Answers: 2

Business, 22.06.2019 10:00

Marco works in the marketing department of a luxury fashion brand. he is making a presentation on the success of a recent marketing campaign that included a fashion show. which slide elements can he use to include photographs and footage of the fashion show in his presentation? marco can use the: table images audio option to include photographs and the: flowcharts images video option to include footage of the fashion show.

Answers: 1

Business, 22.06.2019 11:50

Select the correct answer. ramon applied to the state university in the city where he lives, but he was denied admission. what should he do now? a.change his mind about graduating and drop out of high school so he can start working right away. b. decide not to go to college, because he didn’t have a backup plan. c.stay positive and write a mean letter to let the college know that they made a bad decision. d. learn from this opportunity, reevaluate his options, and apply to his second and third choices.

Answers: 2

Business, 22.06.2019 17:10

Storico co. just paid a dividend of $3.15 per share. the company will increase its dividend by 20 percent next year and then reduce its dividend growth rate by 5 percentage points per year until it reaches the industry average of 5 percent dividend growth, after which the company will keep a constant growth rate forever. if the required return on the company’s stock is 12 percent, what will a share of stock sell for today?

Answers: 1

You know the right answer?

Company abc has liabilities of 20,000, 50,000 and 70,000 due at the end of years 1, 2 and 3 respecti...

Questions

Mathematics, 16.07.2019 05:00

Mathematics, 16.07.2019 05:00

English, 16.07.2019 05:00

Mathematics, 16.07.2019 05:00

History, 16.07.2019 05:00

Mathematics, 16.07.2019 05:00

History, 16.07.2019 05:00

Physics, 16.07.2019 05:00

Mathematics, 16.07.2019 05:00

History, 16.07.2019 05:00