Business, 26.08.2019 18:00 anthonybowie99

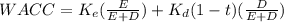

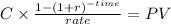

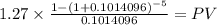

Orchard farms has a pre-tax cost of debt of 7.68 percent and a cost of equity of 15.2 percent. the firm uses the subjective approach to determine project discount rates. currently, the firm is considering a project to which it has assigned an adjustment factor of -0.5 percent. the firm's tax rate is 34 percent and its debt-equity ratio is 0.45. the project has an initial cost of $4.3 million and provides cash inflows of $1.27 million a year for 5 years. what is the net present value of the project

Answers: 3

Another question on Business

Business, 21.06.2019 14:10

What sources about ecuador should you consult to obtain cultural information about this country that will need to be included in your cultural map?

Answers: 2

Business, 21.06.2019 19:00

If a company’s employees are angry about their work, a visiting auditor may also become agitated, illustrating the power of

Answers: 1

Business, 21.06.2019 23:30

Select the correct answer. the word intestate means that a person has died with or without a will?

Answers: 1

Business, 22.06.2019 07:40

Xyz corporation has provided the following data concerning manufacturing overhead for july: actual manufacturing overhead incurred $ 69,000 manufacturing overhead applied to work in process $ 79,000 the company's cost of goods sold was $243,000 prior to closing out its manufacturing overhead account. the company closes out its manufacturing overhead account to cost of goods sold. which of the following statements is true? multiple choice manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000

Answers: 1

You know the right answer?

Orchard farms has a pre-tax cost of debt of 7.68 percent and a cost of equity of 15.2 percent. the f...

Questions

Physics, 04.11.2019 00:31

Biology, 04.11.2019 00:31

Mathematics, 04.11.2019 00:31

Mathematics, 04.11.2019 00:31

History, 04.11.2019 00:31

History, 04.11.2019 00:31

Mathematics, 04.11.2019 00:31

Mathematics, 04.11.2019 00:31

History, 04.11.2019 00:31

Mathematics, 04.11.2019 00:31