Business, 21.08.2019 20:10 ilovecatsomuchlolol

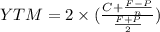

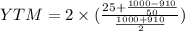

Viserion, inc., is trying to determine its cost of debt. the firm has a debt issue outstanding with 25 years to maturity that is quoted at 91 percent of face value. the issue makes semiannual payments and has an embedded cost of 5 percent annually. a) what is the company's pretax cost of debt? b) if the tax rate is 24 percent, what is the aftrtax debt?

Answers: 3

Another question on Business

Business, 22.06.2019 09:00

Afood worker has just rinsed a dish after cleaning it.what should he do next?

Answers: 2

Business, 22.06.2019 09:40

Newton industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900. the depreciation is $14,700 a year and the tax rate is 34 percent. what effect would an increase of $1 in the selling price have on the operating cash flow?

Answers: 2

Business, 23.06.2019 00:10

Special order carson manufacturing, inc., sells a single product for $36 per unit. at an operating level of 8,000 units, variable costs are $18 per unit and fixed costs $10 per unit. carson has been offered a price of $20 per unit on a special order of 2,000 units by big mart discount stores, which would use its own brand name on the item. if carson accepts the order, material cost will be $3 less per unit than for regular production. however, special stamping equipment costing $4,000 would be needed to process the order; the equipment would then be discarded. assuming that volume remains within the relevant range, prepare an analysis of differential revenue and costs to determine whether carson should accept the special order. use a negative sign with answer to only indicate an income loss from special order; otherwise do not use negative signs with your answers.

Answers: 2

Business, 23.06.2019 00:30

Emerson has an associate degree based on the chart below how will his employment opportunities change from 2008 to 2018

Answers: 3

You know the right answer?

Viserion, inc., is trying to determine its cost of debt. the firm has a debt issue outstanding with...

Questions

Advanced Placement (AP), 06.02.2021 02:10

Mathematics, 06.02.2021 02:10

Mathematics, 06.02.2021 02:10

Mathematics, 06.02.2021 02:10

Geography, 06.02.2021 02:10

Advanced Placement (AP), 06.02.2021 02:10

Mathematics, 06.02.2021 02:10

Mathematics, 06.02.2021 02:10

English, 06.02.2021 02:10

Health, 06.02.2021 02:10

Mathematics, 06.02.2021 02:10

History, 06.02.2021 02:10

Mathematics, 06.02.2021 02:10

Physics, 06.02.2021 02:10