Business, 21.08.2019 02:30 andrewjschoon2876

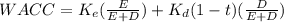

Delta lighting has 24,500 shares of common stock outstanding at a market price of $19 a share. this stock was originally issued at $21 per share. the firm also has a bond issue outstanding with a total face value of $250,000 which is selling for 94 percent of par. the cost of equity is 12.6 percent while the aftertax cost of debt is 5.8 percent. the firm has a beta of 1.33 and a tax rate of 23 percent. what is the weighted average cost of capital?

Answers: 1

Another question on Business

Business, 22.06.2019 08:30

Match the given situations to the type of risks that a business may face while taking credit. 1. beta ltd. had taken a loan from a bank for a period of 15 years, but its sales are gradually showing a decline. 2. alpha ltd. has taken a loan for increasing its production and sales, but it has not conducted any research before making this decision. 3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession. 4. delphi ltd. has taken a short-term loan from the bank, but its supply chain logistics are not in place. a. foreign exchange risk b. operational risk c. term of loan risk d. revenue projections risk

Answers: 3

Business, 22.06.2019 12:30

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 14:40

Increases in output and increases in the inflation rate have been linked to

Answers: 2

Business, 22.06.2019 21:50

Varto company has 9,400 units of its sole product in inventory that it produced last year at a cost of $23 each. this year’s model is superior to last year’s, and the 9,400 units cannot be sold at last year’s regular selling price of $42 each. varto has two alternatives for these items: (1) they can be sold to a wholesaler for $8 each, or (2) they can be reworked at a cost of $251,100 and then sold for $34 each. prepare an analysis to determine whether varto should sell the products as is or rework them and then sell them.

Answers: 2

You know the right answer?

Delta lighting has 24,500 shares of common stock outstanding at a market price of $19 a share. this...

Questions

English, 09.03.2021 14:00

Mathematics, 09.03.2021 14:00

Biology, 09.03.2021 14:00

World Languages, 09.03.2021 14:00

English, 09.03.2021 14:00

Physics, 09.03.2021 14:00

Chemistry, 09.03.2021 14:00

Mathematics, 09.03.2021 14:00

Social Studies, 09.03.2021 14:00

Physics, 09.03.2021 14:00

Mathematics, 09.03.2021 14:00

Biology, 09.03.2021 14:00