Business, 20.08.2019 01:30 eweqwoewoji

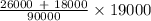

Jim has foreign income. he earns $26,000 from country a which taxes the income at a 20 percent rate. he also has income from country b of $18,000. country b taxes the $18,000 at a 10 percent rate. his us taxable income is $90,000, which includes the foreign income. his us income tax on all sources of income before credits is $19,000. what is his foreign tax credit?

Answers: 3

Another question on Business

Business, 22.06.2019 11:20

You decided to charge $100 for your new computer game, but people are not buying it. what could you do to encourage people to buy your game?

Answers: 1

Business, 22.06.2019 12:30

Provide an example of open-ended credit account that caroline has. caroline blue's credit report worksheet.

Answers: 1

Business, 22.06.2019 18:00

What would not cause duff beer’s production possibilities curve to expand in the short run? a. improved manufacturing technology b. additional resources c. increased demand

Answers: 1

Business, 22.06.2019 19:20

After jeff bezos read about how the internet was growing by 2,000 percent a month, he set out to use the internet as a new distribution channel and founded amazon, which is now the world's largest online retailer. this is clearly an example of a(n)a. firm that uses closed innovation. b. entrepreneur who commercialized invention into an innovation. c. business that entered the industry during its maturity stage. d. exception to the long tail business model

Answers: 1

You know the right answer?

Jim has foreign income. he earns $26,000 from country a which taxes the income at a 20 percent rate....

Questions

Social Studies, 28.04.2021 16:40

Mathematics, 28.04.2021 16:40

History, 28.04.2021 16:40

Mathematics, 28.04.2021 16:40

Chemistry, 28.04.2021 16:40

Mathematics, 28.04.2021 16:40

Chemistry, 28.04.2021 16:40

Mathematics, 28.04.2021 16:40

Mathematics, 28.04.2021 16:40

Geography, 28.04.2021 16:40

Biology, 28.04.2021 16:40

Mathematics, 28.04.2021 16:40

English, 28.04.2021 16:40

Mathematics, 28.04.2021 16:40