The silver corporation uses a predetermined overhead rate to apply manufacturing overhead to jobs. the predetermined overhead rate is based on labor cost in dept. a and on machine-hours in dept. b. at the beginning of the year, the corporation made the following estimates:

dept. a dept. b direct labor cost $60,000 $40,000 manufacturing overhead $90,000 $45,000 direct labor-hours 6,000 9,000 machine-hours 2,000 15,000

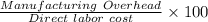

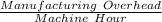

what predetermined overhead rates would be used in dept. a and dept. b, respectively?

(a) 67% and $3

(b) 67% and $5

(c) 150% and $3

Answers: 2

Another question on Business

Business, 22.06.2019 19:30

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

Business, 22.06.2019 21:50

scenario: hawaii and south carolina are trading partners. hawaii has an absolute advantage in the production of both coffee and tea. the opportunity cost of producing 1 pound of tea in hawaii is 2 pounds of coffee, and the opportunity cost of producing 1 pound of tea in south carolina is 1/3 pound of coffee. which of the following statements is true? a. south carolina should specialize in the production of both tea and coffee. b. hawaii should specialize in the production of tea, whereas south carolina should specialize in the production of coffee. c. hawaii should specialize in the production of coffee, whereas south carolina should specialize in the production of tea. d. hawaii should specialize in the production of both tea and coffee.

Answers: 1

Business, 22.06.2019 23:30

Miller company’s most recent contribution format income statement is shown below: total per unit sales (20,000 units) $300,000 $15.00 variable expenses 180,000 9.00 contribution margin 120,000 $6.00 fixed expenses 70,000 net operating income $ 50,000 required: prepare a new contribution format income statement under each of the following conditions (consider each case independently): (do not round intermediate calculations. round your "per unit" answers to 2 decimal places.) 1. the number of units sold increases by 15%.

Answers: 1

Business, 22.06.2019 23:30

How does the federal reserve stabilize and safeguard the nation’s economy? (select all that apply.) it distributes currency and oversees fiscal conditions. it implements american monetary policy. it regulates banks and defends consumer credit rights. it regulates and oversees the nasdaq stock exchange.

Answers: 1

You know the right answer?

The silver corporation uses a predetermined overhead rate to apply manufacturing overhead to jobs. t...

Questions

English, 30.08.2021 21:30

English, 30.08.2021 21:30

English, 30.08.2021 21:30

English, 30.08.2021 21:30

English, 30.08.2021 21:30

Mathematics, 30.08.2021 21:30

Mathematics, 30.08.2021 21:30

Law, 30.08.2021 21:30