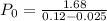

The brown company just announced that they will be increasing their annual dividend to $1.68 next year and that future dividends will be increased by 2.5% annually. how much would you be willing to pay for one share of the brown company stock if you require a 12% rate of return?

Answers: 3

Another question on Business

Business, 22.06.2019 08:30

Most angel investors expect a return on investment of question options: 20% to 25% over 5 years. 15% to 20% over 5 years. 75% over 10 years. 100% over 5 years.

Answers: 1

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

Business, 22.06.2019 23:00

The five steps to financial success a. five money myths b. five foundations

Answers: 1

Business, 23.06.2019 07:50

One cost-of-living indicator available on the internet shows that a salary of $40,000 in santa barbara, california, is equivalent to $14,000 in wichita, kansas. this is primarily because of housing, which is much less expensive in wichita. what does this difference say about how the federal government calculates poverty?

Answers: 3

You know the right answer?

The brown company just announced that they will be increasing their annual dividend to $1.68 next ye...

Questions

Mathematics, 27.09.2019 12:30

Mathematics, 27.09.2019 12:30

Mathematics, 27.09.2019 12:30

History, 27.09.2019 12:30

History, 27.09.2019 12:30

Mathematics, 27.09.2019 12:30

Geography, 27.09.2019 12:30

Computers and Technology, 27.09.2019 12:30

English, 27.09.2019 12:30

Chemistry, 27.09.2019 12:30

English, 27.09.2019 12:30

Geography, 27.09.2019 12:30

= Current price of share

= Current price of share = Dividend to be paid at year end = $1.68 as provided,

= Dividend to be paid at year end = $1.68 as provided, = Cost of equity or expected return on equity = 12% as provided,

= Cost of equity or expected return on equity = 12% as provided,