Business, 13.08.2019 04:20 delincuent5641

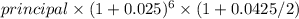

An investor buys a $10,000 par, 4.25 percent annual coupon tips security with three years to maturity. if inflation every six months over the investor's holding period is 2.50 percent, what is the final payment the tips investor will receive

a. $10,213.00 b. $10,869.28 c. $11,822.25 d. $11,843.37 e. $12,201.11

Answers: 1

Another question on Business

Business, 22.06.2019 13:30

If the economy were in the contracting phase of the business cycle, how might that affect your ability to find work?

Answers: 2

Business, 22.06.2019 20:00

Experienced problem solvers always consider both the value and units of their answer to a problem. why?

Answers: 3

Business, 22.06.2019 20:20

Xinhong company is considering replacing one of its manufacturing machines. the machine has a book value of $39,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. it has a current market value of $49,000. variable manufacturing costs are $33,300 per year for this machine. information on two alternative replacement machines follows. alternative a alternative b cost $ 115,000 $ 117,000 variable manufacturing costs per year 22,900 10,100 1. calculate the total change in net income if alternative a and b is adopted. 2. should xinhong keep or replace its manufacturing machine

Answers: 1

You know the right answer?

An investor buys a $10,000 par, 4.25 percent annual coupon tips security with three years to maturit...

Questions

Mathematics, 30.04.2021 22:10

Mathematics, 30.04.2021 22:10

Biology, 30.04.2021 22:10

Arts, 30.04.2021 22:10

Mathematics, 30.04.2021 22:10

Social Studies, 30.04.2021 22:10

Social Studies, 30.04.2021 22:10

Social Studies, 30.04.2021 22:10