Business, 12.08.2019 22:10 evanwall91

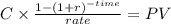

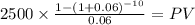

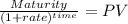

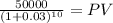

Seaside issues a bond with a stated interest rate of 10%, face value of $50,000, and due in 5 years. interest payments are made semi-annually. the market rate for this type of bond is 12%. what is the issue price of the bond (rounded to nearest whole dollar?

Answers: 1

Another question on Business

Business, 22.06.2019 12:10

This exercise illustrates that poor quality can affect schedules and costs. a manufacturing process has 130 customer orders to fill. each order requires one component part that is purchased from a supplier. however, typically, 3% of the components are identified as defective, and the components can be assumed to be independent. (a) if the manufacturer stocks 130 components, what is the probability that the 130 orders can be filled without reordering components? (b) if the manufacturer stocks 132 components, what is the probability that the 130 orders can be filled without reordering components? (c) if the manufacturer stocks 135 components, what is the probability that the 130 orders can be filled without reordering components?

Answers: 3

Business, 22.06.2019 15:00

Because gloria's immediate concern was the perceived gender discrimination, she would be more concerned about than intent, resultsresults, intentstatistics, trendsrace,gendergender,race

Answers: 2

Business, 22.06.2019 22:00

What resourse is both renewable and inexpensive? gold coal lumber mineral

Answers: 1

Business, 23.06.2019 06:50

Free rein leaders can be described as: a. dictatorial b. authoritarian c. democratic d. permissive

Answers: 1

You know the right answer?

Seaside issues a bond with a stated interest rate of 10%, face value of $50,000, and due in 5 years....

Questions

History, 03.08.2019 14:50

Mathematics, 03.08.2019 14:50

Mathematics, 03.08.2019 14:50

Physics, 03.08.2019 14:50

Social Studies, 03.08.2019 14:50

Mathematics, 03.08.2019 14:50

Mathematics, 03.08.2019 14:50

Biology, 03.08.2019 14:50

Geography, 03.08.2019 14:50

Mathematics, 03.08.2019 14:50

Mathematics, 03.08.2019 14:50

English, 03.08.2019 14:50

History, 03.08.2019 14:50

History, 03.08.2019 14:50