Business, 12.08.2019 21:30 IsabelAyshi

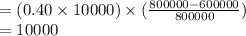

Top company holds 90 percent of bottom company’s common stock. in the current year, top reports sales of $800,000 and cost of goods sold of $600,000. for this same period, bottom has sales of $300,000 and cost of goods sold of $180,000. during the current year, top sold merchandise to bottom for $100,000. the subsidiary still possesses 40 percent of this inventory at the current year-end. top had established the transfer price based on its normal gross profit rate. what are the consolidated sales and cost of goods sold?

a, $1,000,000 and $690,000.

b, $1,000,000 and $705,000.

c, $1,000,000 and $740,000.

d, $970,000 and $696,000.

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Identify the accounting assumption or principle that is described below. (a) select the accounting assumption or principle is the rationale for why plant assets are not reported at liquidation value. (note: do not use the historical cost principle.) (b) select the accounting assumption or principle indicates that personal and business record-keeping should be separately maintained. (c) select the accounting assumption or principle assumes that the dollar is the "measuring stick" used to report on financial performance. (d) select the accounting assumption or principle separates financial information into time periods for reporting purposes. (e) select the accounting assumption or principle measurement basis used when a reliable estimate of fair value is not available. (f) select the accounting assumption or principle dictates that companies should disclose all circumstances and events that make a difference to financial statement users.

Answers: 3

Business, 22.06.2019 14:30

crow design, inc. is a web site design and consulting firm. the firm uses a job order costing system in which each client is a different job. crow design assigns direct labor, licensing costs, and travel costs directly to each job. it allocates indirect costs to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs. direct labor hours (professional) 6,250 hours direct labor costs ($1,800,000 support staff salaries ,000 computer ,000 office ,000 office ,000 in november 2012, crow design served several clients. records for two clients appear here: delicious treats mesilla chocolates direct labor 700 hours 100 hours software licensing $ 4,000 $400 travel costs 8,000 1. compute crow design’s direct labor rate and its predetermined indirect cost allocation rate for 2012. 2. compute the total cost of each job. 3. if simone wants to earn profits equal to 50% of service revenue, how much (what fee) should she charge each of these two clients? 4. why does crow design assign costs to jobs?

Answers: 2

Business, 22.06.2019 20:00

The master manufacturing company has just announced a tender offer for its own common stock. master is offering to buy up to 100% of the company's stock at $20 per share contingent on at least 64% of the outstanding shares being tendered. after the announcement of the offer, the stock closed on the nyse up 2.50 at $18.75. a customer has 100 shares of master stock in his cash account. the customer tells you that he wishes to "cash out" his position. you should recommend that the customer:

Answers: 2

Business, 22.06.2019 21:00

In a transportation minimization problem, the negative improvement index associated with a cell indicates that reallocating units to that cell would lower costs.truefalse

Answers: 1

You know the right answer?

Top company holds 90 percent of bottom company’s common stock. in the current year, top reports sale...

Questions

Chemistry, 16.02.2021 21:40

Mathematics, 16.02.2021 21:40

Mathematics, 16.02.2021 21:40

Chemistry, 16.02.2021 21:40

Mathematics, 16.02.2021 21:40

Social Studies, 16.02.2021 21:40

Mathematics, 16.02.2021 21:40

Mathematics, 16.02.2021 21:40

History, 16.02.2021 21:40

Mathematics, 16.02.2021 21:40

Health, 16.02.2021 21:40

History, 16.02.2021 21:40

Engineering, 16.02.2021 21:40