Business, 02.08.2019 23:10 Calebmf9195

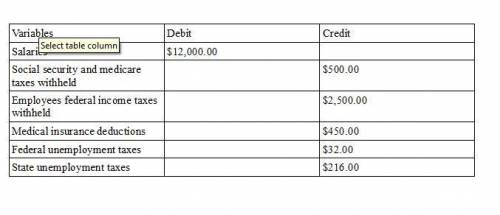

The following totals for the month of april were taken from the payroll register of tapper company. salaries $12,000social security and medicare taxes withheld 550employees federal income taxes withheld 2,500medical insurance deductions 450federal unemployment taxes 32state unemployment taxes 216

the journal entry to record the monthly payroll on april 30 would include aa. debit to salaries payable for $8,500.b. debit to salaries expense for $8,500.c. debit to salaries payable for $8,252.d. debit to salaries expense for $12,000.

Answers: 2

Another question on Business

Business, 22.06.2019 15:20

Record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. the allowance for doubtful accounts before adjustment has a credit balance of $500. b. the allowance for doubtful accounts before adjustment has a debit balance of $250. c. assume that octoberʼs credit sales were $70,000. uncollectible accounts expense is estimated at 2% of sales. smith, gaylord n.. excel applications for accounting principles (p. 51). cengage textbook. kindle edition.

Answers: 1

Business, 22.06.2019 20:30

John and daphne are saving for their daughter ellen's college education. ellen just turned 10 at (t = 0), and she will be entering college 8 years from now (at t = 8). college tuition and expenses at state u. are currently $14,500 a year, but they are expected to increase at a rate of 3.5% a year. ellen should graduate in 4 years--if she takes longer or wants to go to graduate school, she will be on her own. tuition and other costs will be due at the beginning of each school year (at t = 8, 9, 10, and 11).so far, john and daphne have accumulated $15,000 in their college savings account (at t = 0). their long-run financial plan is to add an additional $5,000 in each of the next 4 years (at t = 1, 2, 3, and 4). then they plan to make 3 equal annual contributions in each of the following years, t = 5, 6, and 7. they expect their investment account to earn 9%. how large must the annual payments at t = 5, 6, and 7 be to cover ellen's anticipated college costs? a. $1,965.21b. $2,068.64c. $2,177.51d. $2,292.12e. $2,412.76

Answers: 1

Business, 23.06.2019 13:00

According to the weather forecast, there will be at least 40.5 inches of rainfall next year is an example of which type of probability

Answers: 1

You know the right answer?

The following totals for the month of april were taken from the payroll register of tapper company....

Questions

English, 13.07.2019 14:30

Physics, 13.07.2019 14:30

Mathematics, 13.07.2019 14:30

Biology, 13.07.2019 14:30

Advanced Placement (AP), 13.07.2019 14:30

Mathematics, 13.07.2019 14:30

Mathematics, 13.07.2019 14:30

Mathematics, 13.07.2019 14:30

Chemistry, 13.07.2019 14:30

English, 13.07.2019 14:30

Social Studies, 13.07.2019 14:30

Health, 13.07.2019 14:30