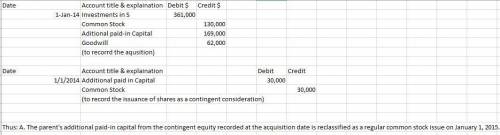

Kaplan corporation acquired star, inc., on january 1, 2014, by issuing 13,000 shares of common stock with a $10 per share par value and a $23 market value. this transaction resulted in recognizing $62,000 of goodwill. kaplan also agreed to compensate star's former owners for any difference if kaplan's stock is worth less than $23 on january 1, 2015. on january 1, 2015, kaplan issues an additional 3,000 shares to star's former owners to honor the contingent consideration agreement. which of the following is true? a. the parent's additional paid-in capital from the contingent equity recorded at the acquisition date is reclassified as a regular common stock issue on january 1, 2015.b. the additional shares are assumed to have been issued on january 1, 2014, so that a retrospective adjustment is required. c. the fair value of the number of shares issued for the contingency increases the goodwill account at january 1, 2015.d. all of the subsidiary's asset and liability accounts must be revalued for consolidation purposes based on their fair values as of january 1, 2015.

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

Using a cps-sample of 7,440 individuals, you estimate the following regression: = 20.91 - 2.61 x female where female is a binary variable that takes on the value of 1 for females and is 0 otherwise. the standard error on the coefficient on female is 0.25. the 95% confidence interval for the gender wage gap, or the amount that females earn less, is: a) [-3.10, -2.12] b) [18.30, 23.52] c) [-3.02, -2.20] d) [-1.96, -1.64]

Answers: 3

Business, 22.06.2019 11:20

Camilo is a self-employed roofer. he reported a profit of $30,000 on his schedule c. he had other taxable income of $5,000. he paid $3,000 for hospitalization insurance. his self-employment tax was $4,656. he paid his former wife $4,000 in court-ordered alimony and $4,000 in child support. what is the amount camilo can deduct in arriving at adjusted gross income (agi)?

Answers: 2

Business, 22.06.2019 15:50

Singer and mcmann are partners in a business. singer’s original capital was $40,000 and mcmann’s was $60,000. they agree to salaries of $12,000 and $18,000 for singer and mcmann respectively and 10% interest on original capital. if they agree to share remaining profits and losses on a 3: 2 ratio, what will mcmann’s share of the income be if the income for the year was $15,000?

Answers: 1

Business, 22.06.2019 16:20

Carlos hears juan and rita’s complaints about the new employees with whom they have to work with, as well as their threats to quit the company. if carlos were to reassign juan and rita to new, unique roles and separate them from the ronny and bill, it would signal that carlos has moved into the stage of managing resistance.

Answers: 3

You know the right answer?

Kaplan corporation acquired star, inc., on january 1, 2014, by issuing 13,000 shares of common stock...

Questions

Physics, 28.03.2020 02:42

Mathematics, 28.03.2020 02:42

Mathematics, 28.03.2020 02:42

Geography, 28.03.2020 02:42

English, 28.03.2020 02:43

Chemistry, 28.03.2020 02:43