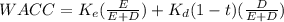

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.79 million at the end of the first year, and these savings will grow at a rate of 3 percent per year indefinitely. the firm has a target debt-equity ratio of .85, a cost of equity of 11.9 percent, and an aftertax cost of debt of 4.7 percent. the cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of 2 percent to the cost of capital for such risky projects. what is the maximum initial cost the company would be willing to pay for the project?

Answers: 3

Another question on Business

Business, 22.06.2019 20:00

Which of the following is a competitive benefit experienced by the first mover firm in an industry? a. the first mover will be able to achieve a less steep learning curve. b. the first mover will be able to reduce the switching costs. c. the first mover will not have to patent its products or technology. d. the first mover will be able to reduce costs through economies of scale.

Answers: 3

Business, 23.06.2019 02:40

P8-4b dropping unfavorable division based on the following analysis of last year's operations of groves, inc., a financial vice president of the company believes that the firm's total net income could be increased by $160,000 if its design division were discontinued. (amounts are given in the thousands of dollars.) required provide answers for each of the following independent situations: a. assuming that total fixed costs and expenses would not be affected by discontinuing the design division, prepare an analysis showing why you agree or disagree with the vice president. b. assume that the discontinuance of the design division will enable the company to avoid 30% of the fixed portion of cost of services and 40% of the fixed operating expenses allocated to the design division. calculate the resulting effect on net income. c. assume that in addition to the cost avoidance in requirement (b), the capacity released by discontinuance of the design division can be used to provide 6,000 new services that would have a variable cost per service of $60 and would require additional fixed costs totaling $68,000. at what unit price must the new service be sold if groves is to increase its total net income by $180,000?

Answers: 2

Business, 23.06.2019 10:00

When the amount paid for land is $36,000 and the amount paid for expenses is $10,000, the balance in total assets after transaction (b) is

Answers: 1

Business, 23.06.2019 14:00

In some markets, the government regulates the price of utilities so that they are not priced out of range of peoples ability to pay. this is a example a/an

Answers: 2

You know the right answer?

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.79 mi...

Questions

German, 16.04.2020 22:26

World Languages, 16.04.2020 22:26

Social Studies, 16.04.2020 22:26

Mathematics, 16.04.2020 22:26

English, 16.04.2020 22:26

Computers and Technology, 16.04.2020 22:26

History, 16.04.2020 22:26

Physics, 16.04.2020 22:26

Computers and Technology, 16.04.2020 22:27