Business, 22.07.2019 19:20 titofigueroa777

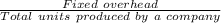

During its first year of operations, the mccormick company incurred the following manufacturing costs: direct materials, $5 per unit, direct labor, $3 per unit, variable overhead, $4 per unit, and fixed overhead, $250,000. the company produced 25,000 units, and sold 20,000 units, leaving 5,000 units in inventory at year-end. income calculated under variable costing is determined to be $315,000. how much income is reported under absorption costing?

Answers: 3

Another question on Business

Business, 22.06.2019 19:00

By 2020, automobile market analysts expect that the demand for electric autos will increase as buyers become more familiar with the technology. however, the costs of producing electric autos may increase because of higher costs for inputs (e.g., rare earth elements), or they may decrease as the manufacturers learn better assembly methods (i.e., learning by doing). what is the expected impact of these changes on the equilibrium price and quantity for electric autos?

Answers: 1

Business, 22.06.2019 20:00

Beranek corp has $720,000 of assets, and it uses no debt--it is financed only with common equity. the new cfo wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. how much must the firm borrow to achieve the target debt ratio? a. $273,600b. $288,000c. $302,400d. $317,520e. $333,396

Answers: 3

Business, 22.06.2019 21:00

Which of the following statements is correct? stockholders should generally be happier than bondholders to have managers invest in risky projects with high potential returns as opposed to safe projects with lower expected returns. potential conflicts between stockholders and bondholders are increased if a firm's bonds are convertible into its common stock. takeovers are most likely to be attempted if the target firm’s stock price is above its intrinsic value. one advantage of operating a business as a corporation is that stockholders can deduct their pro rata share of the taxes the firm pays, thereby eliminating the double taxation investors would face in a partnership.

Answers: 1

Business, 22.06.2019 23:10

R& m chatelaine is one of the largest tax-preparation firms in the united states. it wants to acquire the tax experts, a smaller rival. after the merger, chatelaine will be one of the two largest income-tax preparers in the u.s. market. what should chatelaine include in its acquisition plans? it should refocus its attention from the national to the international market. in addition to acquiring the tax experts, it should also determine the best way to drive independent "mom and pop" tax preparers out of business. chatelaine will need to explain to the federal trade commission how the acquisition will not result in an increase in prices for consumers. chatelaine should enter a price-based competition with its other major competitor to force it out of business and become a monopoly.

Answers: 3

You know the right answer?

During its first year of operations, the mccormick company incurred the following manufacturing cost...

Questions

Mathematics, 11.03.2021 17:30

Mathematics, 11.03.2021 17:30

Mathematics, 11.03.2021 17:30

Social Studies, 11.03.2021 17:30

History, 11.03.2021 17:30

Social Studies, 11.03.2021 17:30

Mathematics, 11.03.2021 17:30

History, 11.03.2021 17:30

Mathematics, 11.03.2021 17:30

Social Studies, 11.03.2021 17:30

Mathematics, 11.03.2021 17:30

History, 11.03.2021 17:30

Mathematics, 11.03.2021 17:30

Physics, 11.03.2021 17:30