Business, 18.07.2019 01:30 bridgetosanders

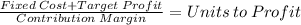

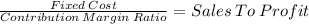

Lin corporation has a single product whose selling price is $130 per unit and whose variable expense is $65 per unit. the company’s monthly fixed expense is $32,150. required: 1. calculate the unit sales needed to attain a target profit of $2,300. (do not round intermediate calculations.) 2. calculate the dollar sales needed to attain a target profit of $8,900. (round your intermediate calculations to the nearest whole number.)

Answers: 2

Another question on Business

Business, 21.06.2019 16:50

New team of management has taken over. as a result, organizational changes from a country-club style leadership where everyone does whatever they want has changed to a more mechanistic, structured, top-down management style. what ethical issues should the employees consider and how should they go about addressing these?

Answers: 2

Business, 21.06.2019 18:50

You are the manager of a firm that produces output in two plants. the demand for your firm's product is p = 20 − q, where q = q1 + q2. the marginal costs associated with producing in the two plants are mc1 = 2 and mc2 = 2q2. how much output should be produced in plant 1 in order to maximize profits?

Answers: 3

Business, 22.06.2019 05:50

Nichols inc. manufactures remote controls. currently the company uses a plantminuswide rate for allocating manufacturing overhead. the plant manager is considering switchingminusover to abc costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows: activities cost driver allocation rate material handling number of parts $5 per part assembly labor hours $20 per hour inspection time at inspection station $10 per minute the current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour. what are the indirect manufacturing costs per remote control assuming an method is used and a batch of 10 remote controls are produced? the batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

Answers: 2

You know the right answer?

Lin corporation has a single product whose selling price is $130 per unit and whose variable expense...

Questions

Mathematics, 29.11.2019 11:31

Mathematics, 29.11.2019 11:31

Physics, 29.11.2019 11:31

Mathematics, 29.11.2019 11:31

Biology, 29.11.2019 11:31

History, 29.11.2019 11:31

Mathematics, 29.11.2019 11:31

Mathematics, 29.11.2019 11:31

Mathematics, 29.11.2019 11:31

Mathematics, 29.11.2019 11:31

Geography, 29.11.2019 11:31