Business, 16.07.2019 17:10 kawaunmartinjr10

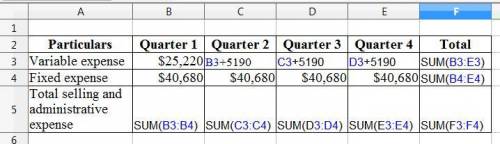

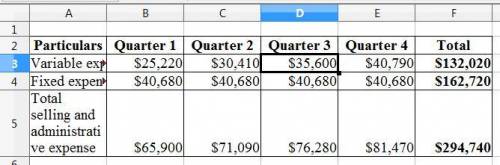

Elbert company classifies its selling and administrative expense budget into variable and fixed components. variable expenses are expected to be $25,220 in the first quarter, and $5,190 increments are expected in the remaining quarters of 2017. fixed expenses are expected to be $40,680 in each quarter. prepare the selling and administrative expense budget by quarters and in total for 2017.

Answers: 2

Another question on Business

Business, 21.06.2019 20:20

After all revenue and expense accounts have been closed at the end of the fiscal year, income summary has a debit of $2,450,000 and a credit of $3,000,000. at the same date, retained earnings has a credit balance of $8,222,600, and dividends has a balance of $125,000. required: a. journalize the entries required to complete the closing of the accounts on december 31. refer to the chart of accounts for exact wording of account titles. b. determine the amount of retained earnings at the end of the period.

Answers: 1

Business, 21.06.2019 20:30

Abond is issued for less than its face value. which statement most likely would explain why? a. the bond's contract rate is higher than the market rate at the time of the issue. b. the bond's contract rate is the same as the market rate at the time of the issue. c. the bond's contract rate is lower than the market rate at the time of the issue. d. the bond isn't secured by specific assets of the corporation.

Answers: 1

Business, 22.06.2019 07:00

Imagine you own an established startup with growing profits. you are looking for funding to greatly expand company operations. what method of financing would be best for you?

Answers: 2

Business, 22.06.2019 07:50

In december of 2004, the company you own entered into a 20-year contract with a grain supplier for daily deliveries of grain to its hot dog bun manufacturing facility. the contract called for "10,000 pounds of grain" to be delivered to the facility at the price of $100,000 per day. until february 2017, the supplier provided processed grain which could easily be used in your manufacturing process. however, no longer wanting to absorb the cost of having the grain processed, the supplier began delivering whole grain. the supplier is arguing that the contract does not specify the type of grain that would be supplied and that it has not breached the contract. your company is arguing that the supplier has an onsite processing plant and processed grain was implicit to the terms of the contract. over the remaining term of the contract, reshipping and having the grain processed would cost your company approximately $10,000,000, opposed to a cost of around $1,000,000 to the supplier. after speaking with in-house counsel, it was estimated that litigation would cost the company several million dollars and last for years. weighing the costs of litigation, along with possible ambiguity in the contract, what are three options you could take to resolve the dispute? which would be the best option for your business and why?

Answers: 2

You know the right answer?

Elbert company classifies its selling and administrative expense budget into variable and fixed comp...

Questions

Mathematics, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

History, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

History, 07.01.2021 22:10

Biology, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

Mathematics, 07.01.2021 22:10

History, 07.01.2021 22:10