Business, 16.07.2019 03:20 giajramosp2r5da

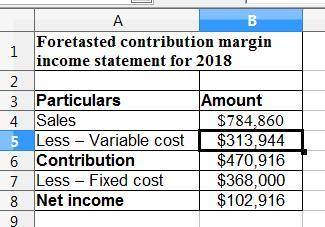

Astro co. sold 20,600 units of its only product and incurred a $55,028 loss (ignoring taxes) for the current year as shown here. during a planning session for year 2018’s activities, the production manager notes that variable costs can be reduced 50% by installing a machine that automates several operations. to obtain these savings, the company must increase its annual fixed costs by $156,000. the maximum output capacity of the company is 40,000 units per year. astro company contribution margin income statement for year ended december 31, 2017 sales $ 784,860 variable costs 627,888 contribution margin 156,972 fixed costs 212,000 net loss $ (55,028 ) prepare a forecasted contribution margin income statement for 2018 that shows the expected results with the machine installed. assume that the unit selling price and the number of units sold will not change, and no income taxes will be due.

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

1. gar principles or "the principles"are intended to do what?

Answers: 2

Business, 22.06.2019 00:50

At a roundabout, you must yield to a. already in the roundaboutb. entering the roundaboutc. only if their turn signal is ond. only if they honk at you

Answers: 1

Business, 22.06.2019 02:00

Benton company (bc), a calendar year entity, has one owner, who is in the 37% federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). bc's gross income is $395,000, and its ordinary trade or business deductions are $245,000. ignore the standard deduction (or itemized deductions) and the deduction for qualified business income. if required, round computations to the nearest dollar. a. bc is operated as a proprietorship, and the owner withdraws $100,000 for personal use. bc's taxable income for the current year is $ , and the tax liability associated with the income from the sole proprietorship is $ . b. bc is operated as a c corporation, pays out $100,000 as salary, and pays no dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . the shareholder's tax liability is $ . c. bc is operated as a c corporation and pays out no salary or dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . d. bc is operated as a c corporation, pays out $100,000 as salary, and pays out the remainder of its earnings as dividends. bc's taxable income for the current year is $ , and bc's tax liability is $ .

Answers: 2

Business, 22.06.2019 04:50

Allie and sarah decided that they want to purchase renters insurance for the apartment they share. they made a list of all of the items to be covered by the insurance policy, along with their estimated values. if the items to be covered total more than $3000, the insurance company charges an annual premium of 23% of the total value of the items. if the items to be covered total $3000 or less, the insurance company charges an annual premium of 20% of the total value of the items.

Answers: 1

You know the right answer?

Astro co. sold 20,600 units of its only product and incurred a $55,028 loss (ignoring taxes) for the...

Questions

Chemistry, 24.03.2020 22:11

Mathematics, 24.03.2020 22:11

Mathematics, 24.03.2020 22:11

Mathematics, 24.03.2020 22:11

English, 24.03.2020 22:12

History, 24.03.2020 22:12

Mathematics, 24.03.2020 22:12

Mathematics, 24.03.2020 22:12

History, 24.03.2020 22:12