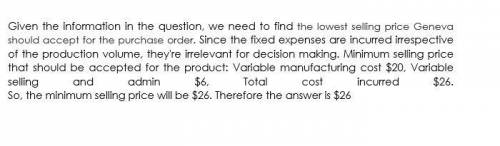

Geneva company manufactures dolls that are sold to various customers. the company works at full capacity for half the year to meet peak demand, and operates at 80% capacity for the other half of the year. the following information is provided: units produced and sold 600,000 units selling price $ 35 / unit variable manufacturing costs $ 20 / unit fixed manufacturing costs $ 1,200,000 / yr. variable selling and administrative costs $ 6 / unit fixed selling and administrative costs $ 950,000 / yr. geneva receives a purchase order to make 5,000 dolls as a one-time event. the good news is that this order is during a period when geneva does have excess capacity. what is the lowest selling price geneva should accept for this purchase order?

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

What is the difference between a public and a private corporation?

Answers: 1

Business, 22.06.2019 06:00

If you miss two payments on a credit card what is generally the penalty

Answers: 1

Business, 22.06.2019 14:40

In the fall of 2008, aig, the largest insurance company in the world at the time, was at risk of defaulting due to the severity of the global financial crisis. as a result, the u.s. government stepped in to support aig with large capital injections and an ownership stake. how would this affect, if at all, the yield and risk premium on aig corporate debt?

Answers: 3

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

You know the right answer?

Geneva company manufactures dolls that are sold to various customers. the company works at full capa...

Questions

English, 28.06.2019 06:40

Health, 28.06.2019 06:40

Chemistry, 28.06.2019 06:40

Biology, 28.06.2019 06:40

Biology, 28.06.2019 06:40

Mathematics, 28.06.2019 06:40

Mathematics, 28.06.2019 06:40

Mathematics, 28.06.2019 06:40

Physics, 28.06.2019 06:40

Mathematics, 28.06.2019 06:40

Mathematics, 28.06.2019 06:40