Business, 13.07.2019 02:30 ittmanny6138

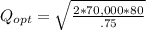

Alarge hospital has an annual demand for 70.000 booklets on healthy eating. it cost $.75 to store one booklet for a year, and it costs $80 to place an order for a new batch of booklets. find the optimum number of copies per order.

Answers: 3

Another question on Business

Business, 22.06.2019 11:40

Vendors provide restaurants with what? o a. cooked items ob. raw materials oc. furniture od. menu recipes

Answers: 1

Business, 22.06.2019 12:10

Compute the cost of not taking the following cash discounts. (use a 360-day year. do not round intermediate calculations. input your final answers as a percent rounded to 2 decimal places.)

Answers: 1

Business, 22.06.2019 12:30

In the 1970s, kmart used blue light specials to encourage customers to flock to a particular department having a temporary sale. a spinning blue light activated for approximately 30 seconds, and then an in-store announcement informed shoppers of the special savings in the specific department. over time, loyal kmart shoppers learned to flock to the department with the spinning blue light before any announcement of special savings occurred. if kmart was employing classical conditioning techniques, what role did the spinning blue light play?

Answers: 3

Business, 22.06.2019 14:40

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate.the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received.c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

You know the right answer?

Alarge hospital has an annual demand for 70.000 booklets on healthy eating. it cost $.75 to store on...

Questions

History, 15.04.2021 06:00

Mathematics, 15.04.2021 06:00

Mathematics, 15.04.2021 06:00

Mathematics, 15.04.2021 06:00

Mathematics, 15.04.2021 06:00

Mathematics, 15.04.2021 06:00