Business, 12.07.2019 03:10 marwaalsaidi

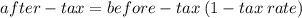

An injection molding machine can be purchased and installed for $90,000. it is in the seven-year gds recovery period and is expected to be kept in service for eight years. it is believed that $10,000 can be obtained when the machine is disposed of at the end of year eight. the net annual value added (i. e., revenues less expenses) that can be attributed to this machine is constant over eight years and amounts to $15,000. an effective income tax rate of 40% is used by the company and the after-tax marr equals 15% per year.

what is the approximate value of the company's before-tax marr?

Answers: 3

Another question on Business

Business, 22.06.2019 04:40

Select the correct answerwhat is the responsibility of each of the twelve federal reserve's banks in their districts? a.they set the prime rateob.they monitor functioning of banks in their through onsite and offsite reviewsc.they assess taxes in their destnictd.they write fiscal policies

Answers: 1

Business, 22.06.2019 17:30

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

Business, 23.06.2019 01:00

"consists of larger societal forces that affect how a company engages and serves its customers."

Answers: 1

Business, 23.06.2019 02:30

George retired from a local law firm and then volunteered to oversee a nonprofit's legal records. george is performing the duties of a:

Answers: 1

You know the right answer?

An injection molding machine can be purchased and installed for $90,000. it is in the seven-year gds...

Questions

English, 21.10.2020 14:01

Biology, 21.10.2020 14:01

Mathematics, 21.10.2020 14:01

Mathematics, 21.10.2020 14:01

Spanish, 21.10.2020 14:01

Biology, 21.10.2020 14:01

Mathematics, 21.10.2020 14:01

Arts, 21.10.2020 14:01

Mathematics, 21.10.2020 14:01

Mathematics, 21.10.2020 14:01

Social Studies, 21.10.2020 14:01

Mathematics, 21.10.2020 14:01