Business, 09.07.2019 06:10 chynahbug72531

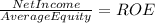

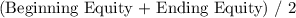

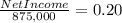

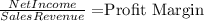

Mib william corp. has $875,000 of assets, and it uses only common equity capital (zero debt). its sales for the last year were $1,020,000, and its net income was $105,000. stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 20.0%. what profit margin would the firm need in order to achieve the 20% roe, holding everything else constant?

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

The following account balances at the beginning of january were selected from the general ledger of fresh bagel manufacturing company: work in process inventory $0 raw materials inventory $ 28 comma 100 finished goods inventory $ 40 comma 600 additional data: 1. actual manufacturing overhead for january amounted to $ 65 comma 000. 2. total direct labor cost for january was $ 63 comma 400. 3. the predetermined manufacturing overhead rate is based on direct labor cost. the budget for the year called for $ 255 comma 000 of direct labor cost and $ 382 comma 500 of manufacturing overhead costs. 4. the only job unfinished on january 31 was job no. 151, for which total direct labor charges were $ 5 comma 200 (1 comma 300 direct labor hours) and total direct material charges were $ 14 comma 400. 5. cost of direct materials placed in production during january totaled $ 123 comma 700. there were no indirect material requisitions during january. 6. january 31 balance in raw materials inventory was $ 35 comma 300. 7. finished goods inventory balance on january 31 was $ 35 comma 400. what is the cost of goods manufactured for january?

Answers: 3

Business, 22.06.2019 11:40

Vendors provide restaurants with what? o a. cooked items ob. raw materials oc. furniture od. menu recipes

Answers: 1

Business, 22.06.2019 15:40

As sales exceed the break‑even point, a high contribution‑margin percentage (a) increases profits faster than does a low contribution-margin percentage (b) increases profits at the same rate as a low contribution-margin percentage (c) decreases profits at the same rate as a low contribution-margin percentage (d) increases profits slower than does a low contribution-margin percentage

Answers: 1

Business, 22.06.2019 17:10

Calculate riverside’s financial ratios for 2014. assume that riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2014. (hint: use the book discussion to identify the applicable ratios.)

Answers: 3

You know the right answer?

Mib william corp. has $875,000 of assets, and it uses only common equity capital (zero debt). its sa...

Questions

History, 11.04.2020 06:18

Biology, 11.04.2020 06:18

Mathematics, 11.04.2020 06:18

Health, 11.04.2020 06:18

Mathematics, 11.04.2020 06:18

Mathematics, 11.04.2020 06:18

Mathematics, 11.04.2020 06:18

English, 11.04.2020 06:18

Mathematics, 11.04.2020 06:18

Mathematics, 11.04.2020 06:18

Mathematics, 11.04.2020 06:19

Biology, 11.04.2020 06:19