Business, 27.06.2019 17:40 savannahsharp4463

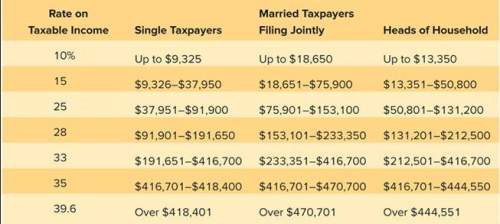

Using the tax table, determine the amount of taxes for the following situations: (do not round intermediate calculations. round your answers to 2 decimal places.) a. a head of household with taxable income of $58,500. b. a single person with taxable income of $36,400. c. married taxpayers filing jointly with taxable income of $72,700.

Answers: 1

Another question on Business

Business, 22.06.2019 14:20

For the year ended december 31, a company has revenues of $323,000 and expenses of $199,000. the company paid $52,400 in dividends during the year. the balance in the retained earnings account before closing is $87,000. which of the following entries would be used to close the dividends account?

Answers: 3

Business, 22.06.2019 18:00

Acountry made education free in mandatory up to age 15. it is established 100 new schools to educate kids across the country. as a result, citizens acquired the _ required to work. the school's generated _ for teachers and other staff. in 20 years, to countryside rapid _ and its gdp.

Answers: 3

Business, 22.06.2019 21:00

Roberto and reagan are both 25 percent owner/managers for bright light inc. roberto runs the retail store in sacramento, ca, and reagan runs the retail store in san francisco, ca. bright light inc. generated a $125,000 profit companywide made up of a $75,000 profit from the sacramento store, a ($25,000) loss from the san francisco store, and a combined $75,000 profit from the remaining stores. if bright light inc. is an s corporation, how much income will be allocated to roberto?

Answers: 2

Business, 22.06.2019 22:20

Which of the following is correct? a. a tax burden falls more heavily on the side of the market that is more elastic.b. a tax burden falls more heavily on the side of the market that is less elastic.c. a tax burden falls more heavily on the side of the market that is closer to unit elastic.d. a tax burden is distributed independently of the relative elasticities of supply and demand.

Answers: 1

You know the right answer?

Using the tax table, determine the amount of taxes for the following situations: (do not round inte...

Questions

Chemistry, 27.05.2021 07:20

Mathematics, 27.05.2021 07:20

Mathematics, 27.05.2021 07:20

Mathematics, 27.05.2021 07:20

Mathematics, 27.05.2021 07:20

Mathematics, 27.05.2021 07:20

Chemistry, 27.05.2021 07:20

Mathematics, 27.05.2021 07:20

Mathematics, 27.05.2021 07:20