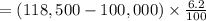

The chief executive officer earns $20,000 per month. as of may 31, her gross pay was $100,000. the tax rate for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the current futa tax rate is 0.6%, and the suta tax rate is 5.4%. both unemployment taxes are applied to the first $7,000 of an employee's pay. what is the amount of fica-social security withheld from this employee for the month of june?

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

If a team of three workers, each making the u.s. federal minimum wage, produced these 12 rugs, what would the total labor cost be? don't forget that these workers would be working overtime.

Answers: 3

Business, 22.06.2019 19:00

Question 55 ted, a supervisor for jack's pool supplies, was accused of stealing pool supplies and selling them to friends and relatives at reduced prices. given ted's earlier track record, he was not fired immediately. the authorities decided to give him an administrative leave, without pay, until the investigation was complete. in view of the given information, it would be most appropriate to say that ted was: demoted. discharged. suspended. dismissed.

Answers: 2

Business, 22.06.2019 22:00

Which of the following is a function performed by market prices? a. market prices communicate information to buyers and sellers. b. market prices coordinate the decisions of buyers and sellers. c. market prices motivate entrepreneurs to produce those products that are currently most desired relative to their costs of production. d. all of the above are functions performed by market prices.

Answers: 2

Business, 22.06.2019 23:30

Miller company’s most recent contribution format income statement is shown below: total per unit sales (20,000 units) $300,000 $15.00 variable expenses 180,000 9.00 contribution margin 120,000 $6.00 fixed expenses 70,000 net operating income $ 50,000 required: prepare a new contribution format income statement under each of the following conditions (consider each case independently): (do not round intermediate calculations. round your "per unit" answers to 2 decimal places.) 1. the number of units sold increases by 15%.

Answers: 1

You know the right answer?

The chief executive officer earns $20,000 per month. as of may 31, her gross pay was $100,000. the t...

Questions

English, 09.03.2020 01:16

Mathematics, 09.03.2020 01:16

Mathematics, 09.03.2020 01:17

Mathematics, 09.03.2020 01:18

History, 09.03.2020 01:18

Computers and Technology, 09.03.2020 01:19

Mathematics, 09.03.2020 01:19

Mathematics, 09.03.2020 01:19

Mathematics, 09.03.2020 01:19

History, 09.03.2020 01:19

Chemistry, 09.03.2020 01:19